It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

And away we go …

Credits and Debits

Debit: There are more signs that the 30-year bond bubble is finally coming to an end, as global bonds lost $1.7 trillion last month; that’t the worst monthly meltdown on record.

Debit: Of course, that’s terrible news for government pension funds because they hold oodles of those bonds. You can bet Dallas mayor — and former Pizza Hut CEO — Michael Rawlings, knows that. He’s now warning that the police and fireman’s pension is pushing his city “toward the fan blades of municipal bankruptcy.” Somebody better call 9-1-1.

Debit: Bonds aren’t the only asset class that’s in a bubble. The housing market is too. Unfortunately, falling bond prices ultimately lead to higher mortgage interest rates — which is really bad news considering that, all things considered, US homes have never been more expensive to buyers who need a mortgage.

Debit: The US government uses the cash from those bonds to help fund itself. After all, the National Debt is now $20 trillion — in part because of “worthy” federal projects like the recent $2 million study by the National Institute of Health to learn why kids don’t like to eat food that has been sneezed on. I know.

Credit: Frankly, if you’re looking for a scape goat for the asset bubbles, rising living expenses, stagnant wages, and everything else that’s wrong with our economy, blame the Federal Reserve Bank that enables the government’s profligate spending with their poisonous free-money policies and our fraudulent debt-based monetary system. The Fed has got to go.

Credit: As financial analyst Bill Bonner notes: “Increasing the money supply doesn’t increase wealth or GDP; it only changes the relation of available goods and services to available money. Eventually, the falcon of asset prices becomes deaf to the falconer of the real economy. Then he gets lost and flies into a tree. Asset prices fall to the ground. Investors panic.” Well … that’s one way to put it.

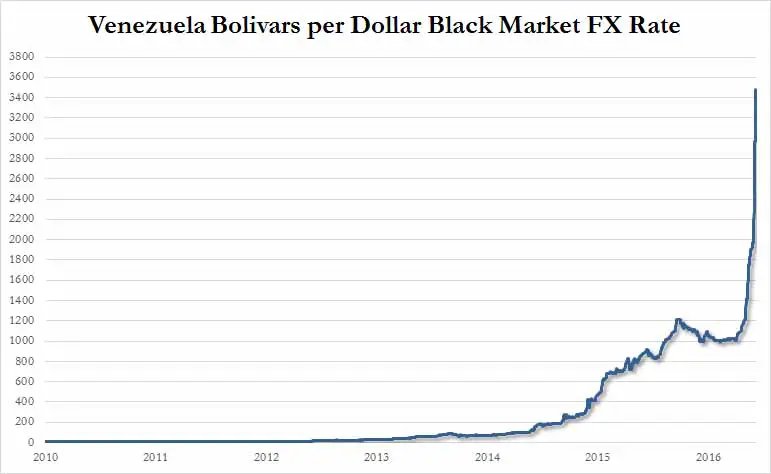

Credit: Then, when things get really bad, confidence disappears, your currency crumbles, and the lines form at ATMs. For a contemporary example, look no further than the People’s Socialist Paradise of VenezuelaTM, where last week their bolivar fell 15% — in a single day. In fact, charts like this are why Venezuelans regret that they didn’t keep at least a portion of their savings in precious metals:

Credit: In an ideal, honest money system using gold (and silver), it’s impossible to lend money you don’t have and prices remain roughly stable. Even better, you don’t have to worry about a central bank increasing the money supply faster than new goods and services enter the economy, thereby silently robbing you of your wealth.

Debit: Maybe that’s why earlier this week President-elect Trump interviewed John Allison for the position of Treasury secretary; Allison is an ex bank CEO who wants to abolish the Fed and return to the gold standard. Unfortunately, he didn’t get the job.

Debit: On a related note, a man walking down a busy New York City street took advantage of two inattentive armored truck guards by walking off with a bucket containing 86 pounds of gold. No, really. For those of you counting at home, that’s 1254 troy ounces worth $1.6 million.

Credit: If he’s ever caught, the man will be charged with grand theft. Then again, the real crime is how 86 pounds of the yellow metal currently only fetches $1.6 million in a world that’s buried under more than $200 trillion of debt.

Credit: By the way, thanks to Venezuela’s hyperinflation, 86-pounds of their 100-bolivar notes — more than 39,000 bills in all — is currently worth a measly $1950 on the black market. And within the next several weeks it’ll be only half that amount. Forward!

By the Numbers

Here are a few more nauseating examples of government waste, courtesy of Senator Jim Lankford (R-Oklahoma):

$500,000 For a study to find the connection between religion, politics and cemeteries in 12th century Iceland.

$200,000 To study 500-year old fish bones in a Tanzanian city to identify a connection between food and social status.

$1,000,000 On a campaign to tell mothers that they should prevent their teenage daughters from tanning.

$495,000 For a temporary exhibit that shared the best of medieval smells.

$3,000,000 For a 12-episode soap opera to promote the prevention of HIV/AIDS.

$412,000 On a paper arguing that glaciers are best-studied using feminist theories.

Source: Zero Hedge

Insider Notes: An Economic Implosion Scenario

Hey! You need to be an Insider to view this section! If you’d like to join, please click “Insider Membership” at the top of my blog page.

Last Week’s Poll Results

Did you do any shopping on Black Friday this year?

- No (75%)

- Yes, but only online (16%)

- Yes (9%)

More than 1200 Len Penzo dot Com readers responded to last week’s question and it turns out that, even though Black Friday was the biggest consumer spending soiree of the year, just 1 in 4 did any shopping at all that day — online or otherwise. Count me among the group that didn’t shop at all on Black Friday.

The Question of the Week

[poll id="140"]

Other Useless News

Programming note: Unlike most blogs, I’m always open for the weekend here at Len Penzo dot Com. There’s a fresh new article waiting for you every Saturday afternoon. At least there should be. If not, somebody call 9-1-1.

Hey! If you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Don’t forget to subscribe via email too! Thank you.

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider!

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

From Rudy:

You really know your stuff. Good job!

Thanks, Rudy. If you think I know my stuff, you should meet the Honeybee — she knows everything.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Thanks for another interesting Saturday morning post Len!

I’m glad you mentioned the action in the bond market again. It’s been pretty crazy how much value has been lost so fast. And as you mentioned, financing is looking particularly dire for some of the municipalities, based on the action in those bond markets.

And while a widening yield curve may be profitable for banks, I’m not sure how the interest payments are going to be sustainable when the country has over $20T in debt!

That’s the elephant in the room, Jay. The US — and rest of the world, for that matter — cannot afford to pay even the average interest rate over the past century (between 5% and 6%), let alone the high double-digit rates that Fed Chair Paul Volcker imposed in the early 1980s to restore confidence in the US dollar and break the back of killer inflation.

Len, if you think about it, interest rates are still pretty low. So how can houses be more expensive than ever?

Have a great weekend!

When you consider household real wages today vs. the past (which measures purchasing power after subtracting for inflation) coupled with the interest rates, mortgages are more expensive than ever, Sara.

And you have a wonderful weekend too!

Trump was never going to pick Allison. You can’t have a gold standard if you are planning on increasing the national debt by trillions on infrastructure and other spending like Trump is proposing.

Yes, there would have to be a debt jubilee and an economic reset before any type of gold-backed currency or gold standard could be implemented.

Len,

What you are saying here about the ramifications of a reset is so important. Getting out of the mess we are in will require across-the-board sacrifice. I would appreciate your expanding on what your feel we need to do individually and collectively to escape the hole into which we’ve been dug. Keep up the good work.

Steve: Individually, I believe we need to prepare both financially to minimize the impacts of the lower standard of living is coming to most Americans — and to protect our families from potential temporary disruptions that ay occur from broken supply chains. I write about that here.

Collectively, the world needs to return to a monetary system that is based upon honest money, just as it was prior to the creation of the Fed in 1913 — or at least partially as it was between the Bretton Woods Agreement in the 1940s until Nixon closed the gold window in 1972. It is not a coincidence that the corruption all around us in all levels of government — as well as the moral decline that is seen in much of society today — is directly attributable to our current corrupt debt-based monetary system.

The French Revolution was sparked by rapid debasement of their currency … America is risking a similar fate if we don’t change the current system we have before it too collapses entirely.

Hey Len, I’ve been a subscriber to your RSS feed for a few months now but I still haven’t received my personal thank you letter. Im just wondering if its because perhaps you’ve been hiding out in the bunker lately?

Regardless, I always enjoy the articles and your perspective on the world.

I particularly look forward to Black Coffee every week. Great stuff, thanks!

I’m sorry, James. My bad. I’ve been busy installing booby traps.

Anyway, thank you so much for the kind words. Oh … and please be sure to check your inbox for my personal thank you too!

Venzuela has the largest oil reserves on Earth. How in the world can they be so broke?

Socialism. Plain and simple.

That being said, the US will be in a similar boat as Venezuela if they wait for the dollar to collapse until the International Monetary System is fixed.

Unfortunately, the dollars we are currently using to pay our bills will most likely lose at least half their value anyway even if they do fix the IMS first.

Len,

So much for draining the swamp! The mention of Allison was to just keep the Constitutionalist like myself happy, unfortunately an ex Goldman Sux employee got the job! What’s the saying “The more things change the more they stay the same”? I think the precious metals may have bottomed, but I guess a lot hinges on the Italian referendum.

Same ole same ole!

Jared

I know, Jared. I’ve was very disappointed with his selection of Mnuchin as Treasury Secretary.

Meet the new boss … same as the old boss.

As for precious metals, I’ve given up on trying to predict which way they’re going to move. I just buy them on a regular basis … and buy a little more on top of that when the bankers hammer them and put them on sale.

I’ll bet that gold heist was an inside job. Any takers?

If it wasn’t, can you imagine the thief’s surprise when he opened the bucket and found 86 pounds of gold? I’m sure he was probably figuring that he had stolen a bucket full of quarters, dimes and nickels …

All of your examples of gov’t waste is the perfect explanation why almost all presidents want but are never granted line item veto.

Yes, the line item veto for budget bills is badly needed, Kathy.