It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s dive right in this week …

Credits and Debits

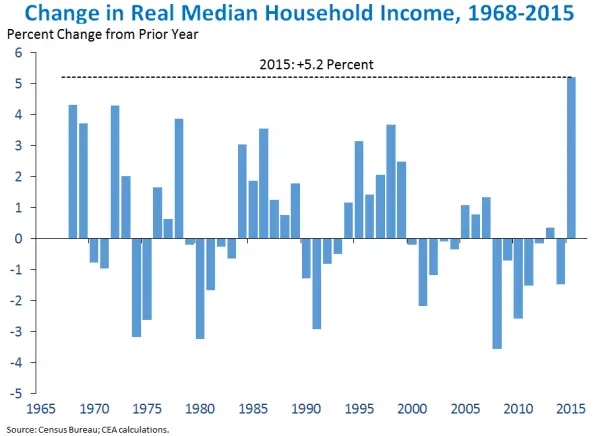

Credit: According to the US Census Bureau, median household income rose to $56,516 in 2015; that’s up a whopping 5.2% from a year earlier — it also marks only the second increase in median income since 2007. Wow!

Credit: CNN proudly proclaimed that, “The jump in median income was one of the largest annual increases the Census has recorded.” I’ll say; that 5.2% figure is bigger than any wage gains made during the booming 1980s when average GDP growth was more than twice what it is today. Double wow!!

Debit: Hey … I know what you’re thinking: If you feel like you missed the party, you’re not alone. But what CNN didn’t say was that the data is based upon a new measurement methodology implemented by the Census in 2013. Uh huh.

Debit: In other words, the income data is just more government bull $#&%!

Credit: Then again, in this day and age, I’m sure there are more than a few people out there who will say with a straight face that they see nothing strange with the latest government figures. What do you think? Take a look:

Debit: If we assume the sharp rise in wages is real, then it strongly suggests workers now have the upper hand over desperate employers looking to fill open positions. I hope somebody tells that to all of the homeless people who are currently living in the dozens of tent cities across America now.

Debit: US economic health may be up for debate, but the rest of the world is definitely struggling. And paper cash is proving to be a critical impediment to the oppressive negative interest rate campaign currently being waged by the world’s central banks in order to jump start the global economy. Frankly, their plan is nuttier than squirrel $#&%.

Debit: Of course, $#&% happens, and the central banks are eventually going to fail because their debt-based international monetary system is a Ponzi scheme that’s quickly reaching its mathematical limit. If they don’t radically overhaul the system, this is where we’re headed — with or without negative rates:

Credit: By the way, central bank PhDs believe negative rates encourage spending — which is probably why investment advisor Mish Shedlock sent this snarky tweet last week: “Negative Interest Rate Theory: Supposedly, getting people to buy things they do not need or want will create prosperity!” Indeed. Obviously, Mish understands that PhD stands for “Piled higher and deeper.”

Credit: It’s also just as obvious why @federalreserve and @ECB don’t follow him on Twitter.

Credit: In Switzerland, the bizarre world of negative rates has resulted in more and more companies taking out insurance policies — at an annual rate of $1000 per $1 million — to protect the cash stored in their corporate vaults. In other words: NIRP has turned insurance companies into de facto banks — and fellow competitors too. Oops.

Debit: It’s not just big corporations that are trying to protect their cash from negative rates — the little people are too, which is why it’s no coincidence that ivory-tower Harvard academic, Kenneth Rogoff, is making a big push for banning paper currency altogether. Again.

Credit: However, as the always-eloquent economist Jim Grant points out, “Strip away the technical pretense and what you have is politics. Rogoff wants the government to control your money. It’s as simple as that.” That it is, Jim. Unfortunately, it appears as if most people can’t see that. Or maybe they just don’t give a $#&%. If not, they should.

By the Numbers

The collapse of South Korea’s Hanjin Shipping, the world’s seventh-largest container carrier, has disrupted global trade networks and driven up freight rates. Here are some key numbers:

141 The number of ships Hanjin has. More than half are currently blocked from docking, and four have been seized as of Sept 11.

$14,000,000,000 The estimated value of cargo tied up globally while Hanjin ships sit idle outside ports that wont let them in.

$38,000,000 The value of goods, mostly TVs and appliances, that Samsung Electronics alone has said it has stuck aboard two Hanjin ships.

7.8% Trans-Pacific trade volume for the U.S. market carried by Hanjin.

400,000 The estimated number of containers stranded on Hanjin ships.

$226,000,000 Hanjin’s second-quarter operating loss in 2016, on revenue of $1.3 billion.

$5,500,000,000 Hanjin’s debts at the end of June 2016.

Source: Fortune

The Question of the Week

[poll id="129"]

Last Week’s Poll Result

What is the highest auto insurance deductible on your primary car?

- $500 to $1000 (59%)

- More than $1000 (28%)

- Less than $500 (12%)

More than 1000 people answered this week’s survey question and 3 in 5 have a $500 or $1000 deductible on their primary vehicle. Count me among the 3 in 10 who will have to shell out more than a grand the next time I decide to make a claim on my car. Er … assuming I decided to make a claim.

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Ontario (2.22 pages/visit)

2. Saskatchewan (2.14)

3. Alberta (1.58)

4. Nunavut (1.50)

5. Manitoba (1.45)

9. Newfoundland and Labrador (1.38)

10. British Columbia (1.33)

11. Prince Edward Island (1.30)

12. Yukon Territory (1.25)

13. Northwest Territories (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Ontario, eh) — or not (ahem, you hosers living on the frozen Northwest Territories tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

This week GC disputed my claim that whirlpool tubs are for suckers:

I’m not sure what you people are talking about. Sure, you have to clean it a lot but, wow, you have to keep it clean anyway.

Thank you. I rest my case.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Thanks for another great recap Len. And I’m glad I’m not the only one who’s head is spinning on account of negative interest rates and all their unexpected consequences!

Thanks, Jay.

Negative (and zero) rates truly have turned the financial world and all of the traditional tenets of smart financial planning upside down — especially when it comes to borrowing and saving, where borrowers are richly rewarded and savers are severely punished.

This is not going to end well. For a worst-case scenario, one only has to look at the the French Revolution to see a similar example of what can happen when a financial system becomes corrupted by an over-printed currency.

I can’t understand how governments on one hand say the economy is just great while in the same breath considering negative rates. People seem really blind to that.

Hording cash in a safety deposit box seems like a way to hide from a negative fee, but if the dollar devalues quickly, you can’t hide from that. Regardless if it’s a digit in an account or paper, a loss in value is impossible to hide from, except in metals. But who knows if this occurs the ones with metals might find a new (old ) law making it illegal to hold them personally, most likely just before the run on the dollar…

Paul, making precious metals illegal will only drive their use underground. They will continue to be used as currency in the black market.

Len, why do you say the insurance companies are like banks now? It seems like I learn something new from you almost every week. Looking forward to your answer!

Thank you, Sarah! Businesses and people who choose to pay insurance companies an annual premium to protect their stored cash from theft or damage are essentially paying negative interest rates. The insurance-company rate is currently negative 0.1% (based upon an annual premium of $1000 per $1 million insured). So as long as those insurance premiums remain cheaper than the negative interest rates being charged by the banks, the incentive will remain to keep cash out of the banks — and the insurance companies will have the opportunity to take those disgruntled customers from the banks.

What is infuriating is that the MSM takes the BS data as gospel and a large segment of the population read it and assume it’s truth. I know you blame the bankers for a lot of the mess we’re in, but I think the real trouble started when the media stopped being objective and became a shill for the government.

I think there is a lot of truth in your comment, Wilson. Good post.