It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I trust that many of you are familiar with the story of Peter Pan, in which it says, ‘the moment you doubt whether you can fly, you cease forever to be able to do it.’ What we need is positive attitude and conviction.

— Bank of Japan Governor Haruhiko Kuroda (June 3, 2015)

Credits and Debits

Debit: Golf’s British Open just ended but, the week prior to that, the UK was hosting the spectacle that is Wimbledon tennis where Serena Williams was crowed the women’s singles champion. Unfortunately for her, the grand prize was $380,000 less after the post-Brexit plunge in the pound sterling. Ouch. Somehow, though, I think she’ll survive.

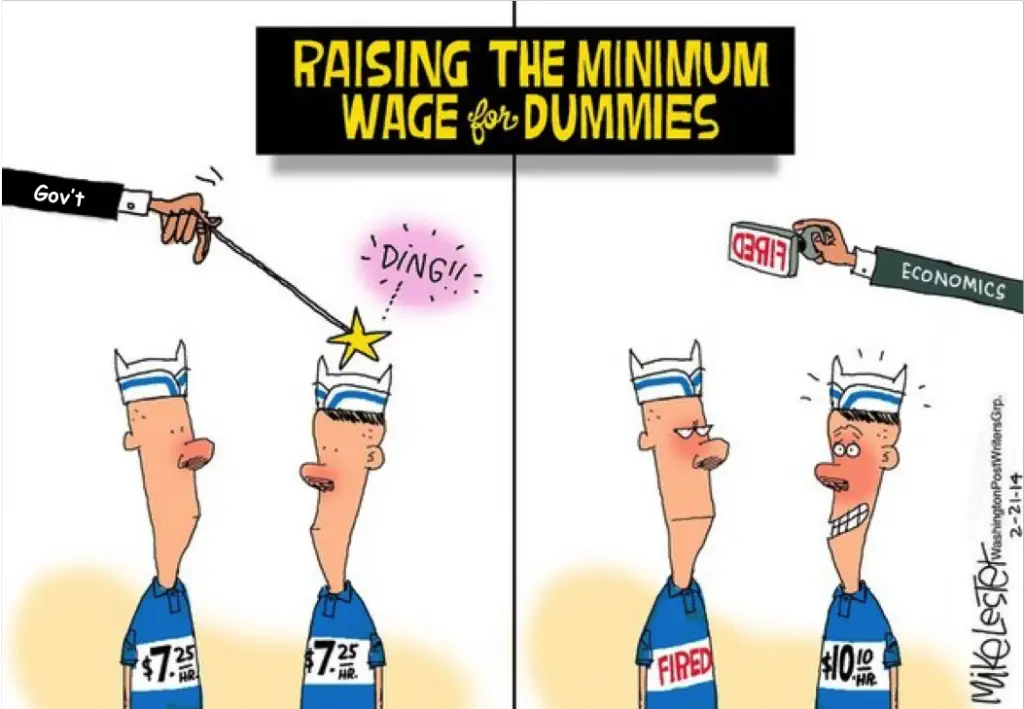

Debit: Speaking of falling earnings, I see that the Seattle employment level has fallen after their economically-clueless councilmen imposed upon the city’s businesses a forced-march towards a $15 minimum wage for unskilled labor. Imagine that.

Credit: This cartoon is a couple of years old now, but it’s message is still on-point:

Debit: You know what else is funny? (Or not.) A social justice group in Maine that is seeking a $12 per hour base wage posted jobs paying … wait for it … $10 an hour. They’re insisting that it was a mistake. Heh. Sure it was. I think the only “mistake” was that they got caught.

Credit: Meanwhile, despite the lack of good high-paying manufacturing jobs in America and stagnant wages, US stock market indices are at all-time highs. Is it just me, or does somebody on Main Street need to ask the folks on Wall Street for an explanation?

Credit: After all, as financial analyst Andy Hoffman notes, the soaring US markets make zero sense when one realizes that, “Institutions have withdrawn capital from equity funds for 17 weeks running amidst horrific economic and geopolitical developments — let alone, plunging corporate earnings.” I know, Andy. I know.

Debit: One thing is certain: there’s a growing number of “helicopter money” trial balloons now being sent up by the Fed. Obviously, the stock market approves — and why not? “Helicopter money” is simply a colloquial term for outright Weimar-style debt monetization. In other words: Get your wheelbarrows ready!

Credit: Then again, why shouldn’t stocks soar? Back in 2007, after its central bank rolled out the helicopter money in earnest, Zimbabwe had the best performing stock index in the entire world — but only in nominal terms:

Credit: Of course, all of this talk about helicopter money begs the question: If stock markets are already at all-time highs then why do we need it?

Credit: Yes, the question was rhetorical, but I’ll be rude and answer it anyway: It’s because the international monetary system is on its death bed. The helicopter money is simply palliative care until the US dollar crosses to the other side.

Debit: Needless to say, we’re in this mess because of the scourge of central banking, and its misguided belief that a handful of ivory tower finance apparatchiks can do a better job at determining the price of money — also known as interest rates — than the free market. At least that’s what Tinker Bell told them.

Debit: If you’re curious about what waits for all of us at the end of the road if those in power refuse to return the world to a monetary system tied to honest money, then look no further than the People’s Socialist ParadiseTM of Venezuela, where the standard of living continues to plumb new depths with each passing day.

Credit: In Venezuela, rising consumption, steady employment, guaranteed pensions and socialized healthcare are, as the Associated Press notes, “running aground on the unwelcome reality that promises made decades ago can no longer be kept.” The AP is too kind. Most people would say the ship actually sank years ago.

Debit: The stark reality, however, is that the US is in the very same economic boat, but that won’t become apparent until the US dollar finally — and most assuredly — loses its reserve status. Only then will most Americans realize that the lifestyle they too ordered is suddenly out of stock.

By the Numbers

As I mentioned in the intro, the British Open — the oldest major in golf — played this week at Scotland’s Royal Troon Golf Club. Here are a few facts:

1860 The year that the inaugural British Open was held.

$1.67 million The payout to this year’s Champion Golfer of the Year.

29 Number of Americans who have won the Open Championship.

22 Number of British Open winners produced by Scotland.

14 Number of British Open winners from England.

14 Number of courses that have hosted the 145 editions of the British Open.

6 Number of times Harry Vardon won the British Open. (Yes, that’s a record.)

71 The age of Gene Sarazen during the 1973 British Open, when he made a hole-in-one at Royal Troon’s par-3 8th hole, known as the Postage Stamp.

6 The number of shots the fourth-ranked golfer in the world, Rory McIlroy, took to extricate his ball from an infamous Postage Stamp bunker during a practice round last Tuesday. Take a look:

Source: Forbes

The Question of the Week

[poll id="120"]

Last Week’s Poll Result

How old were you in your earliest memory?

- 3 (32%)

- 4 (20%)

- 5 (17%)

- 2 (16%)

- I’m not sure (11%)

- 1 or younger (5%)

More than 1000 people answered this week’s survey question and slightly more than half say their first memory goes back to a time when they were either 3 or 4 years old. Not bad … as for me, although I can’t prove it, my first memory occurred at an age when I was less than a year old.

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Manitoba (2.05 pages/visit)

2. Quebec (2.04)

3. Nova Scotia (1.58)

4. Alberta (1.54)

5. Ontario (1.52)

9. Newfoundland and Labrador (1.42)

10. New Brunswick (1.41)

11. Saskatchewan (1.39)

12. Yukon Territory (1.25)

13. Prince Edward Island (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Manitoba, eh) — or not (you hosers living on Prince Edward Island) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

Brenda dropped me a note to say hi — and ask this question:

Love your blog, Len! Why didn’t you give it a fancy name like all the other (personal finance) blogs out there?

Well … because “John Smith dot Com” was already taken.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Len, I’m still learning about how our money system works so forgive my confusion. It looks like the Zimbabwe stock market went straight up! How can that not be positive? Keep up the great work!

Hi, Sara. Thank you!

To answer your question: The index went up but its real value when measured in hyperinflating Zimbabwe dollars resulted in declining purchasing power. That is, the nominal value of the Zimbabwe stock index was increasing, but not fast enough to overcome the rapidly climbing inflation rate. Or, to put it yet another way: inflation was eating away the value of those stocks at a faster rate than they could climb — even though the price of those stocks would double or triple in a single day!

That inflation was a symptom of the overly-printed Zimbabwe dollar in its death throes.

Sara King –

nominal value is the value BEFORE inflation is taken into consideration

real value is the value AFTER inflation

Len, keeping a positive attitude particularly believing in your fullest potential can make a difference in finance journey. I used to be a pessimist, but when I change how I deal with things with having a positive attitude, I see that my life is getting better and better. I think it’s better to be positive as opportunities come so rarely.

I agree, Jayson. But there are also times when it pays to recognize you’re facing a serious problem so action can be taken to either: 1) fix the problem, or 2) protect yourself if the trouble is too big to avoid.

It’s a personal responsibility thing.

The good news is: everyone who reads my weekly missives here has the opportunity to protect themselves. Those who do, will come out of this just fine. Those who don’t will not.

If keeping the minimum wage low (at or below the federally dictated level) is good for job growth and opportunity why is stagnant wage increases not just as good. Both options leave more money in the job creators’ coffers which allow them to theoretically create more jobs. I don’t understand how stagnant wage growth for the so-called middle class is bad but no wage growth for the so-called working poor is good– talk about min wage increases as a bad thing but middle income wage increases as a good thing–are they not one in the same? I don’t think we should just wake up one morning and minimum wage has magically doubled, but shouldn’t its growth at least keep up with whatever growth rate that is happening within the economy?

Help set me straight on this. I’m great at personal finance (debt free, mid-50’s, 27-year enlisted military vet, 12-years as a teacher, cash-flowed college for both kids, and set to retire in June of 2017) but a little ignorant at macro-economics .

Keith, first off — thank you for your service.

As for your question … You’re conflating government-imposed increases in artificial minimum wage laws with middle class wages that are determined by the free-market.

To be clear: I never claimed no wage growth for the working poor is good. The problem is government interference in the free market: bureaucrats and politicians who artificially set wages at the lower end without regard to economic feasibility or the laws of supply and demand.

Ideally, wages for every job — including unskilled entry-level positions such as janitors and fry cooks — should be determined by mutual agreement between employee and employer; doing so provides the maximum economic benefit to both parties.

However, by inserting itself into the process, the government distorts both the job market and the business’ bottom line — and this leads to inefficiencies (e.g., a smaller job-market, lower production rates, smaller profits, etc.) that wouldn’t otherwise exist.

In a truly free market, wages for everyone — including fry cooks, janitors and WalMart greeters — would find their natural level via supply and demand, rising or falling as circumstances required. This is not a pipe dream: until last year, there was no minimum wage law in Germany. And today there are still more than few countries in Europe who do not have one including Denmark, Italy, Cyprus, Austria, Finland and Sweden.

The free market is an amazing thing when it is allowed to work, unfettered by government interference. Unfortunately, the government has its tentacles in almost every facet of it.

Dear Len and readers, Obama and Hillary have more central planning like the government setting minimum wages, in store for America. He and she plan for a “one world order” where the government determines everything for everyone because individuals are too stupid (Obama says this in this clip) to plan for themselves. My relatives suffered for fifty years under Communism and seeing this planned for all of us is chilling:

http://www.youtube.com/watch?v=YfRtbIQ1kTw&feature=youtu.be

Karen: I will leave the video for others to see, but it was discredited (i.e., the video was carefully edited to change the original message).

Misleading videos like this are not helpful or necessary to make the point that statism is a scourge that must be eradicated.

Hello Len,

First time reader here, and I must say, youve sufficiently frightened me. I do my best to get information (especially potentially volatile information regarding the collapse of a monetary system) from multiple credible sources until I arrive at a personal conclusion. Its just this weird thing I do as Id rather think for myself instead of simply mimicking the biases of someone else. After looking through some of your site, it seems that you might approve of such behavior.

My question isnt meant to imply anything beyond the scope of the question itself: If the dollar really is in its death throes, why does there seem to be such a lack of credible sources saying as much?

I realize the word credible poses problems, and being no economist myself, perhaps there is more alarm-sounding out there than I might be aware of.

Whatever the case may be, I believe youll have an amusing answer for this one. Keep up the (quite certainly) good work.

I’m glad you found my site, Benjamin! I hope you’ll stick around.

By “credible” I think you mean mainstream media. I’ll try to keep the answer as simple as I can. It’s no secret that most people in the mainstream media have an agenda that depends on the continuation of the current corrupt fiat monetary system. A financial system that is based on honest money would torpedo their agenda because a monetary system based upon precious metals — rather than debt — keeps a yoke on large ever-expanding centralized government and the “services” and pet projects that come with it.

That’s why the mainstream media will never do anything to shake confidence in the current fiat-based Ponzi scheme that is the dollar-based international monetary system — because confidence is the only thing that is keeping it afloat.

Unfortunately for the mainstream media, the math is not on their side. Confidence is beginning to crumble, even in the face of their complicity.