It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s get right to it …

Credits and Debits

Credit: In case you missed it, the current bull market in stocks became the second longest in US history last month; the S&P 500 is up 212% since March 2009. Hooray!

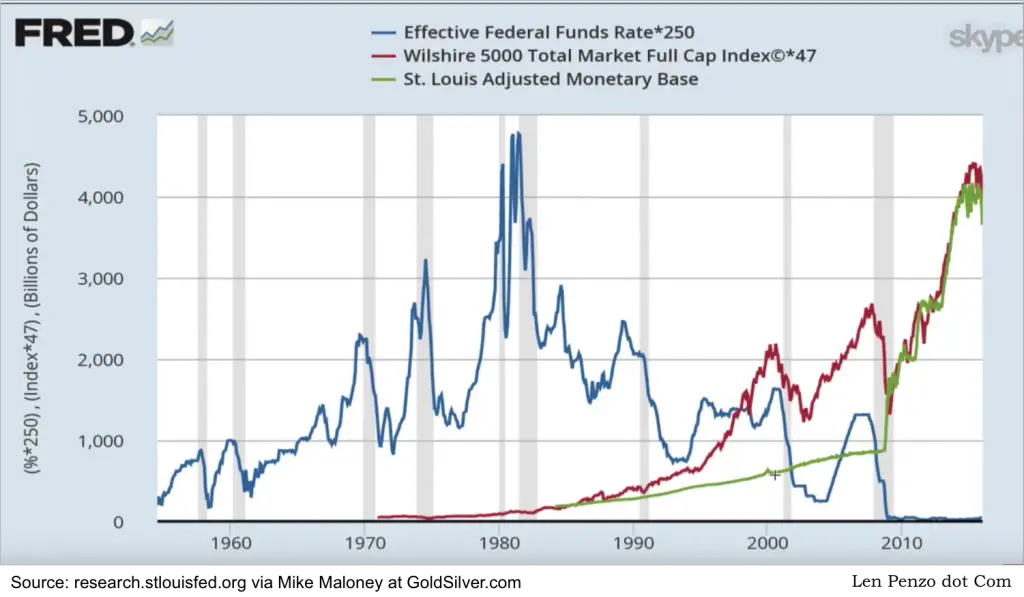

Debit: On the other hand, as Mike Maloney illustrates with the Fed’s own data, all of those gains are directly attributable to the Fed’s massive money printing campaign over the same time period. Nonsense, you say? Then what is your explanation for the correlation between the red and green lines here:

Click to enlarge.

Debit: What’s truly amazing is that stocks are still hovering near all-time highs despite a growing mountain of negative economic data, including the May jobs report which showed the worst job growth figures in six years — approximately 100,000 jobs under what’s typically required to keep pace with population growth. Unbelievable.

Debit: And if you think that’s unbelievable, try this: Despite the awful jobs report, the “official” unemployment rate miraculously dropped to 4.7%. No, really.

Debit: The truth is, the US economic system is rotting and needs more and more lipstick from Fed chair Janet Yellen to keep the ruse going. I know. Eat your heart out, CoverGirls!

Debit: Things can’t be good when nearly half of all Americans are currently unable to pay for a $400 emergency without borrowing or selling something. The writer who authored the report called those individuals “financially fragile.” And while that’s clever … I’ve got a far-better alliterative adjective than “fragile.”

Debit: Then again, who needs a job when you can simply own a house in Vancouver, Canada. Why do I say that, you ask? Because, as Zero Hedge wryly observes: “Last year Vancouver homeowners made more cash from sitting on their assets than the entire city did by working.” And you hosers thought San Francisco’s housing market was in bubble territory.

Debit: Of course, just like the artificially puffed-up stock market, ridiculous housing prices everywhere are a result of central bank money printing and a textbook example of how “free” money — or “free” healthcare, or “free” … well … anything else for that matter — leaves everyone poorer in the long run.

Credit: On the bright side, at least America has an awesome government-managed healthcare system. Well, it’s awesome if you don’t mind that premiums are rising faster than wages — and aren’t worried that 13 of the 23 Obamacare exchanges have officially failed …

Debit: … or own a Che Guevara t-shirt.

Credit: Speaking of Che … I see the proles in the People’s Socialist Paradise of VenezuelaTM — the same ones who voted to toss self-reliance out the window in favor of living off of other people’s money — are now standing in lines for scarce goods as long as seven hours and, wait for it … they’re still not getting what they need. Forward!

Credit: Psst, hey, Pedro: Quien es John Galt?

Credit: Finally … Did you see this? A North Carolina man bit into a McDonald’s double cheeseburger and discovered a folded $20-bill sandwiched between the two meat patties. Heh. It’s nice to see the Golden Arches courting those who insist they’ll only eat something off the menu if you pay them.

Last Week’s Poll Result

How often do you typically barbecue during summertime?

- About once per week (34%)

- Rarely, if ever (29%)

- More than once per week (20%)

- One or two times per month (17%)

More than 1700 people answered last week’s question and a little more than half of them say they barbecue at least once per week during the summer months. At the same time, almost 3 in 10 say they rarely, if ever, bother to fire up the grill. At my house, the grill is fired up at least three times per week from May through September. For me, it’s the only way to cook when it’s so hot outside that you can almost fry an egg on the sidewalk.

The Question of the Week

[poll id=”115″]

By the Numbers

Speaking of barbecues, here are a few more fun facts on the tasty topic:

1697 Year that the word “barbecue” was first recorded (by British buccaneer William Dampier).

71% Americans who barbecue on July 4th, the most popular holiday for cookouts.

2 Memorial Day’s rank among the most popular days for grilling. (57% of population)

85% People who enjoy grilling hamburgers, the most popular food for barbecuing.

80% People who say they enjoy barbecuing steak.

5 Percentage of Americans who prefer a rare steak.

8 Percentage of Americans who prefer their steak well. (Otherwise known as “ruined.”)

1 Rank of long-handled tongs among the list of most popular barbecue utensils. (The fork was runner up.)

1897 Year the charcoal briquette was patented.

2 Cities that claim to be the barbecue capital of the US. (Kansas City and Memphis)

Sources: MobileCuisine.com; FiveThirtyEight

Insider Notes: Why Collectivism Is an Economic Failure — Every Time

Hey! You need to be an Insider to view this section! If you’d like to join, please click “Insider Membership” at the top of my blog page.

Other Useless News

Here are the top — and bottom — five states in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Montana (2.73 pages/visit)

2. New Hampshire (2.66)

3. New Mexico (2.12)

4. Alaska (2.00)

5. Arizona (1.91)

46. West Virginia (1.44)

47. Oklahoma (1.42)

48. Ohio (1.40)

49. Wyoming (1.30)

50. Rhode Island (1.29)

Whether you happen to enjoy what you’re reading (like my friends in Montana) — or not (ahem, Rhode Island) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my post describing 41 reasons why I won’t lend you money, Joe left this comment:

Anyone pandering this crap to get clicks is a bigger deadbeat than anyone I know who might need a couple bucks from time to time.

Somehow, I get the feeling you’d change your mind if I said I’d loan you a couple bucks.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Len,

I am thinking about using some of my stacking money towards mining stocks, they have really started kicking since gold and silver have began to rally. I’m just wondering if they will be safe when the market crashes? I figure much of the wealth in the market will slide over to gold and silver mining stocks as well the precious metals themselves. Rickards is adamant that gold is going to $10,000 an ounce and I figure if anyone was to own gold mining stocks this would be even better then owning gold itself. What’s your opinion on this?

Jared

Jared: I’m dabbling in a gold mining index ETF (GDX) but only a very small amount. It is up more than 60% this year.

Any gains (or losses) in mining stocks will rise (or fall) in multiples to the price of gold and silver. My concern is three-fold:

1) Ultimately, unless you hold the physical paper certificates yourself, any stocks you hold are controlled by a custodian — and that introduces counterparty risk. If the (financial system) economy goes belly up, the stocks’ value may be through the roof, but if the custodian fails, there is a risk you can lose your investment.

2) Fear of mining companies being nationalized in the event of a severe financial system shock or currency failure.

3) Punitive windfall taxes

Until a new monetary system is in place, I am erring on the side of caution and keeping as much of my savings as I can in the only real assets that have ZERO counterparty risk. In other words: the return OF assets trumps the return ON assets.

The directions to make a double cheeseburger say to add cheddar, the guy making the burger was only following directions. Going forward, McDonald’s is going to have to clarify that to mean processed cheese food, not money.

Good one, Hannah!

The McDonald’s thing is not new. Maybe it was the 1950s when Harry Golden wrote about going into the lunch wagon business during the Depression with a mentally challenged fellow Ukrainian immigrant. They made sandwiches and peddled them to factories and shops where the help had only a half hour for lunch and wanted something cheap and filling. There was much cut throat competition and Golden and partner eked out a subsistence living with their lunch wagon business. One day Golden sold out before doing half his route. The next day he sold out before finishing 1/3 of his route. He went back to his partner and said, “I must take the $200. we hid away for a rainy day and buy more supplies so I can sell more sandwiches.” Golden looked but the money was gone. He asked his partner about the money and the man hemmed and hawed and said “I put it back in the business.” “Where in the business?” asked Golden. “Here and there.” his partner replied. Turns out the man took one dollar bills, wrapped them in waxed paper and inserted them in the occasional sandwich, hence the frantic demand. Unfortunately there was no money left to buy sufficient supplies and the business went bankrupt.

An excellent metaphor for what is happening to America. Essentially, by over-printing the dollar, we’re eating our own seed corn too. The end result will be the same.

awesome article