It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

It’s hard to believe, but this week my blog celebrated its seventh birthday. Yep. Way back on December 11, 2008, yours truly decided to kick off his newfound writing hobby with this modest little entry. At the time, I never dreamed that Len Penzo dot Com would ever become as big as it has; over the years, this little ol’ blog has chalked up nearly 8 million page views — and the best part is, it continues to grow with each passing month. Hooray!

Anyway … whether you’re a long-time follower or a relative-newbie here, I want to thank all of you for your continued interest and support — including the complaints and criticisms. Well … most of them.

And with that, off we go …

Credits and Debits

Debit: The new calendar year begins in a few weeks, but the US fiscal year is already two months old — and spending, tax rates, and the budget deficit already increased over the past 60 days. The government monster is growing — and consuming everything in its path.

Debit: Did you see this? It turns out that the 20 richest Americans own more wealth than half the US population. Wow. Apparently, 50% of Americans are poorer than I thought.

Credit: Maybe Malaysia’s Kuala Lampur International Airport should ask one of those rich Americans if they’re the mystery owner of three 747s that are still sitting on their tarmac after landing there more than a year ago. I know of people who forgot where their car was parked — but a 747?

Debit: Meanwhile, the Fed is signaling it will raise interest rates by 25 tiny basis points on Wednesday and the financial markets are having a hissy fit: the Dow had its worst week since August, bond yields are collapsing, crude oil is at a seven-year low, the dollar is falling, and junk bonds are plummeting.

Debit: Common sense suggests that bonds are in an even bigger bubble than stocks — after all, they’ve been in a bull market for 35 years now. In fact, the bond market is so big, financial experts are worried that its “circling the drain” because it lacks the liquidity required to keep a catastrophic meltdown from occurring. No, really.

Credit: If that doesn’t prove to you how dependent the fraudulent US economy has become on interest rates holding at the zero-bound, I don’t know what would. When this house of cards finally collapses, look out below.

Credit: Why is our economy in such a dire financial mess? Well, as financial analyst John Rubino points out, it’s because: “The US is engaged in an experiment to see how long an economy can function with services growing and manufacturing contracting.” In short: we’re not creating enough stuff. Well … unless you count waiters and bartenders.

Credit: Of course, this twisted financial experiment — led by the mad money-scientists at the Fed — will eventually fail in spectacular fashion, if only because no nation can maintain a high standard of living when it continually consumes more than it produces.

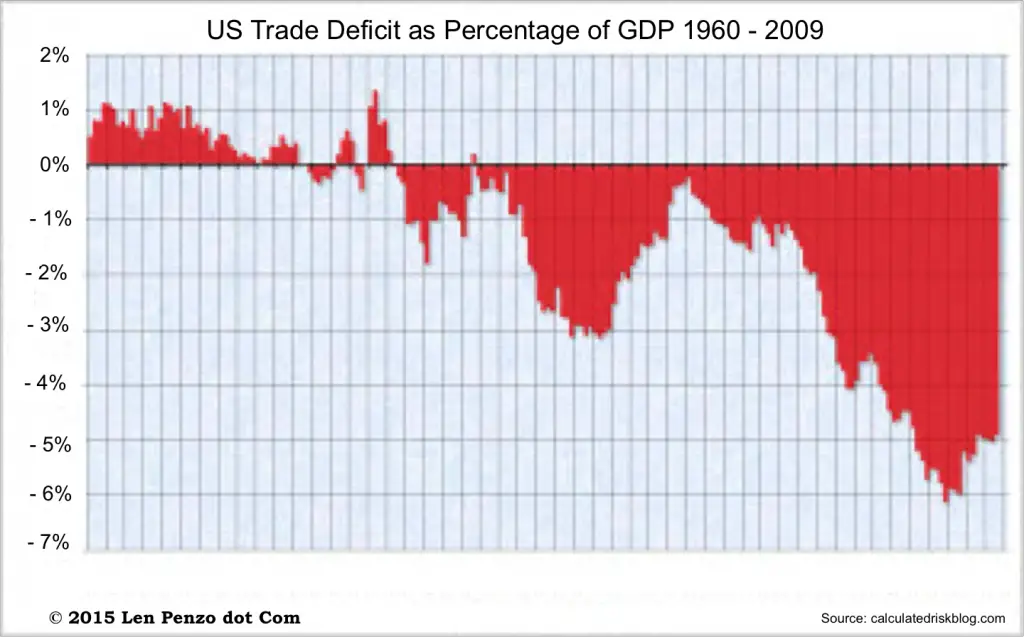

Debit: Nations prefer exchanging real goods like oil for airplanes, or lumber for corn; short of that, they want gold. For more than 40 years, however, the US has been paying frustrated trading partners with increasingly worthless dollars. It’s a game that won’t go on much longer, folks — and understandably so. Look:

Debit: Speaking of mad experiments, I see Canada is officially thinking about joining desperate central bankers on the other side of the Atlantic by imposing negative interest rates. Then again, desperate times call for desperate measures. I guess.

Credit: Finally, don’t look now, but the lone Obamacare co-op to make a profit in 2014, Maine’s Community Health Options, is now losing millions. In fact, things are so bad that they’ve stopped taking new enrollees. The company blames higher-than-expected medical costs. Heh. Tell us about it.

By the Numbers

In case you’re wondering, the data is in and it turns out that Black Friday sales in the US didn’t light the retail world on fire in 2015. Here are a few numbers:

$10,400,000,000 Total Black Friday sales this year; that’s down 10% from 2014.

$1,800,000,000 Total sales on Thanksgiving; that was down 10% from 2014 too.

22,000,000 Number of Black Friday shoppers who visited Walmart in 2015.

36 Percentage of all online sales captured by Amazon on Black Friday; that’s more than any other company.

8 Percentage of all online Black Friday sales made by Best Buy, which came in second place among all retailers.

8 Days before Black Friday that Amazon officially began offering Black Friday sale deals. Cheaters.

Source: The Motley Fool

The Question of the Week

[poll id=”91″]

Last Week’s Poll Result

Which of these traits would you rather have?

- Eat without getting fat (40%)

- A photographic memory (33%)

- Never get tired (16%)

- Everyone likes you (11%)

More than 900 people chimed in for this week’s question and a strong plurality — 2 in 5 people — indicated that they’d prefer the ability to eat without getting fat over having a photographic memory, getting through the day without ever getting tired, or having an irresistible charisma. Me too. Frankly, I thought that number would be higher — especially with the holidays upon us. Shows you what I know.

Other Useless News

Here are the top — and bottom — five states in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. South Dakota (1.95 pages/visit)

2. Arkansas (1.90)

3. Alaska (1.84)

4. North Dakota (1.83)

5. New Mexico (1.82)

46. Connecticut (1.39)

47. Oklahoma (1.38)

48. South Carolina (1.37)

49. Rhode Island (1.36)

50. Wyoming (1.28)

Whether you happen to enjoy what you’re reading (like my friends in South Dakota … for the second month in a row!) — or not (ahem, Wyoming) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article on how to know when it’s time to stop giving gifts to nieces and nephews, KenCo added a caveat of his own:

Of course, the gift-giving will end prematurely if no Thank You (note, email, call) is made.

Even better: You could send them a pencil and some stationery the following Christmas!

I’m Len Penzo and I approved this message.

Photo Credits: hdwallpapers_cat

Len,

Who decides what is a “Credit” and what is a “Debit”? The dog? We love your blog!

Ha ha! Thanks, Rick. The editor always gets the final say regarding what is a credit and what is a debit. Always.

But maybe one of these days I’ll let our dog choose, just for fun!

Len,

Right now I’m using 10% of my fiat money to purchase metals every month. Things seem to be quickening, should I maybe increase that to 30%? What percentage of your portfolio are you putting into metals at this time? Any additional information would help? Do you forsee things going so bad that I may need some extra can food and water saved up? I feel we are running out of time, even though I did see the Renimbi isn’t supposed to be made a reserve currency until October 1st 2016. Maybe this will give us a little extra time to prepare. I think that will be the catalyst in destroying the Dollar.

Jared

Jared, I’m currently putting 15% of my fiat toward precious metals on a monthly basis.

As I’ve mentioned many times before, including here, I believe people should have three to six months of food, water and other essentials in hand before they begin buying precious metals. In my opinion, they should also have Federal Reserve Notes on hand because, when the system breaks, credit cards will no longer be accepted, ATMs will stop working and so, ironically, cash will be king for a short while (I’m guessing several weeks). Just as water on the coastline recedes far offshore just prior to a tsunami, this will be the financial analogue: credit will dry up and cash-in-hand will become extremely scarce and valuable — then the government will be forced to print print print and the nation will find itself awash in an endless sea of dollars (which soon-after will become worthless, or nearly worthless).

When this is all over, life in America is going to become much tougher for almost everyone; as economic mother nature restores and rebalances the world to its true financial state (by reallocating living standards based upon true economic output: i.e., countries with large trade imbalances will be punished monetarily, while those with surpluses will be rewarded with a rising standard of living). There will be social unrest as people see their lifetime savings evaporate and supply chains may break temporarily, leaving many people hungry and desperate.

The good news is, the reset will allow the US to become an economic powerhouse once again (i.e., a manufacturing powerhouse), providing real opportunities and the associated benefits for everyone who takes part in it.

The days of endless free lunches will soon be over; our artificially-high standard of living is going away. It’s scary, but it is also necessary — and there is a happy ending in the cards for our children and grandchildren.

Jamie, I think it’s because most people’s finances are tapped out. All that borrowing from previous years has constrained consumers from expanding their purchases this year because they still owe money from the past. That’s the trouble with borrowing: it’s a parlor trick that simply brings future purchases into the present — the downside is, unless you can increase your income, that adversely affects future consumption.

Happy Anniversary Len!

Thanks, David! And thanks for being a long-time loyal reader too!

What are your thoughts on all of these ads for “Store at home gold IRA”?

In theory, I love it. The big question on them is whether or not they are allowed by the IRS, Jerry. Of course, the companies offering them say there is a loophole in existing tax law that allows them. I’ve heard other people say that isn’t an ironclad assumption.

Len,I’m still trying to get a handle on some of the things you talk about, so forgive me if these questions are stupid.I’m just trying to understand it all.

What is fiat and how do you invest in precious metals on a “monthly” basis?

What is a federal reserve note and where do you get them?

Are you actually storing a 6 month supply of bottled water for your whole family?

Do you have a list of what kind of things you should have on hand (as far as canned food, supplies?

Where do I begin?

Margaret, there is no such thing as a stupid question. Here are some brief answers:

1. “Fiat” is a term to describe the US dollar (and every other currency in the world today). Fiat currency is cash that is not backed by anything tangible (like gold and/or silver) — it’s “value” is derived solely by the issuing government declaring it (by fiat) to be “legal tender” for paying debts and taxes. Fiat currency works in practice as long as the public has confidence in it (i.e., that it is seen as a legitimate and effective store of value). If a nation over prints its currency, then confidence dries up and hyperinflation takes root, thereby killing the currency. Zimbabwe is the most recent example. In 2009 its currency imploded after the government printed it into oblivion. I have a handful of $100 trillion zimbabwe dollars (that $100-trillion bill would only buy three eggs right before the currency died) on my desk as a reminder that all fiat currencies eventually end up returning to their true intrinsic value — zero!

2. I buy precious metals as insurance, not as an investment. That being said, any one can buy precious metals on a monthly basis by going to a local coin dealer, or via an online precious metals exchange such as APMEX.

3. A Federal Reserve Note is the US dollar (i.e., the green paper in your purse or wallet with pictures of dead presidents, treasury secretaries and founding fathers on them). 🙂

4. I currently have approximately 175 gallons of water stored for an emergency in dozens of 3.5 gallon stackable easy-to-store containers called “water bricks.” I wrote about that here.

5. As for what supplies to have on hand, I discussed that topic in several of my Economic Collapse 101 articles. The broadest overview can be found here.

For a complete list of all of my Economic Collapse 101 articles, click here.

If you have more questions, drop me an email: Len@LenPenzo.com