It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Let’s get right to it this week …

Credits and Debits

Credit: As Larry Berman said this week: “It’s amazing that so many people think the US economy is doing just fine. Let’s look at the facts. The-debt-to-GDP ratio at the end of 2007 was 64%. It’s currently expected to be 105% by the end of 2015.” He may be on to something.

Credit: Based on Baltimore Ravens guard John Urschel’s decision to bypass the typical luxury car that most NFL players drive in favor of a used 2013 Nissan Versa that he bought for $9000 — despite earning $564,000 last year — I’d say John knows the US economy is in bad shape too.

Debit: Frankly, the signs of an impending worldwide economic depression and financial collapse are getting harder for anyone to ignore — and I’m not just talking about the continuing debt crisis in Greece, or sickly US stock market fundamentals either.

Debit: After falling for seven consecutive sessions, the Dow was already on its worst losing streak since 2011 before it took it on the chin again after China devalued the yuan last Tuesday — and then again on Wednesday.

Debit: Of course, true economic growth is difficult to achieve when incomes aren’t rising — and real wages in the US have, incredibly, fallen every single quarter since the Great Recession ended in 2009.

Debit: That sobering income statistic is validated by the fact that fully 7 in 10 Americans now say debt is a necessity in their lives. Thanks to the Fed’s war on interest rates, saving has become a lost art.

Debit: Yes, yes … Years of cheap dollars from the Fed allows economically unviable companies like Tesla Motors to stay in business even though it loses $4000 on every car it sells. That cheap cash has also allowed the real estate market to soar unabated despite falling wages.

Credit: Then again, the time it takes to flip a home is now the longest it has been in eight years — or in other words: right before the last housing crash.

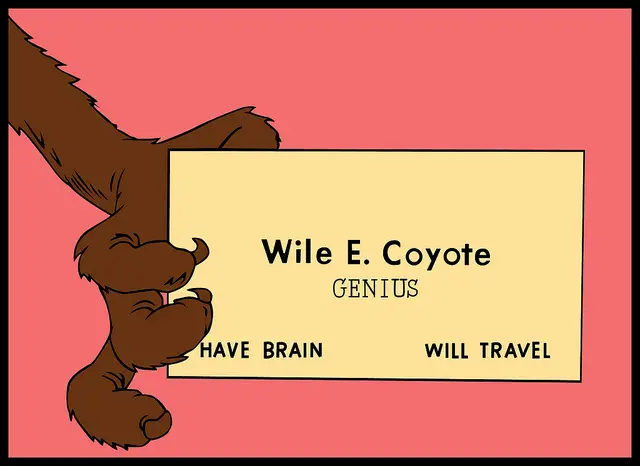

Credit: In terms of those classic Road Runner cartoons, we’re now at the point where the blatant disconnect between the high-flying housing market and stagnant wages is represented by this Wile E. Coyote moment:

Credit: Just like Wile E. Coyote, I’m sure the housing market will continue defying gravity until wide-eyed prospective homebuyers finally decide to open their eyes — and look down.

Debit: Here’s a newsflash, folks: The dollar isn’t money — it’s an IOU backed by nothing but faith. And that’s why our sinister monetary system requires ever-expanding debt to avoid a collapse. The trouble is: there’s no such thing as a free lunch — no matter what Big Government pols tell you.

Debit: That free lunch mentality may be alive and well in America, but the current monetary system is now in its death throes precisely because it’s getting harder with each passing day to accrue more debt. Why? Well … because the world is tapped out, that’s why.

Debit: You can bet the Fed knows it’s trapped; after 44 years of unrestrained spending, it doesn’t take a super genius to see that there is so much debt on the books now that raising rates is impossible without uncovering the economic charade. Sorry, Wile E.

Credit: So what are the Fed’s options? Well, short of a debt jubilee — or a monetary system reset — all that’s left are: continuing with the deflationary collapse, or monetizing the debt until it ultimately destroys the currency via hyperinflation.

Debit: US politicians know that the dollar’s days are numbered — which is why they’re positioning themselves to say “I told you so” when this pathetic house of cards finally falls. How else can you explain the US Secretary of State’s recent warning that the US dollar would crash if the Iran deal was not approved by Congress? No, really.

By the Numbers

Here’s a closer look at some of the numbers behind Tesla Motors:

52 Number of Tesla showrooms in the US and Canada.

$100,000Average sales price of all cars sold by Tesla.

21,552 Cars sold by Tesla Motors so far this year.

0 Patent lawsuits Tesla Motors says they will bring against anyone who uses their technology in good faith.

23 Percent of Tesla stock owned by CEO Elon Musk.

6 Number of parts that need regular replacement on a Tesla vehicle. (4 tires and 2 wiper blades.)

2 Tesla Motors’ ranking among the oldest publicly-traded US car companies. (Only Ford is older; GM went bankrupt — and its new stock is four months younger than Tesla’s.)

Source: Visual Capitalist; Wall Street Journal

The Question of the Week

[poll id="75"]

Last Week’s Poll Result

When was the last time you drank a glass of tap water?

- Within the last week (47%)

- More than a year ago (31%)

- Within the last year (14%)

- Within the last month (8%)

More than 500 people answered this week’s survey question and I’m not surprised to see that nearly 1 in 3 Len Penzo dot Com readers haven’t had a glass of tap water in more than a year.

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Saskatchewan (2.13 pages/visit)

2. Alberta (2.10)

3. Manitoba (1.95)

4. New Brunswick (1.91)

5. Prince Edward Island (1.88)

9. British Columbia (1.59)

10. Newfoundland and Labrador (1.54)

11. Yukon Territory (1.50)

12. Northwest Territories (1.25)

13. Nunavut (1.11)

Whether you happen to enjoy what you’re reading (like those crazy Canucks in Saskatchewan, eh) — or not (you hosers living on the frozen Nunavut tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

This week, Iris left this question for me in my inbox:

Hey, Len! So tell me. Do you cheat on your taxes?

“Iris,” huh? Call me paranoid, but I don’t think it’s a coincidence that you can’t spell Iris without IRS.

I’m Len Penzo and I approved this message.

Photo Credits: brendan-c; (Road Runner and Wile E. Coyote) Chuck Jones

Len,

You forgot to mention that Silver is getting harder and harder to come by! I am still waiting for some Buffaloes to be shipped from Apmex I ordered 2 weeks ago. I cant believe how many people want these pet rocks and how worthless they have become! Lmao the main stream calls Gold and Silver pet rocks! Guess I should paint faces on my tree outside and call it Dollar tree, whats fools we have running this country!

Longing for the Reset!

Jared

I bought some silver from APMEX myself a couple weeks ago, Jared. I love a good sale, don’t you?!

Len,

I think yesterday and today might be the beginning of the end! Stock market is in a death spiral!

Reset time! Maybe!

Jared

Yes, Jared, the wheels are really starting to come off the bus now. Monday will be interesting. It all depends on whether or not the Plunge Protection Team can stop the carnage.

I think we have a little while longer to go before the reset though. I think we know we’ll be getting close when we see them holding an emergency multi-day or multi-week meeting of the G7 — or G20 (kind of like Bretton Woods in 1944).

If I was a betting man, I’d say any reset is going to happen over a weekend — that is, we’ll wake up one Monday morning to a whole new financial world.

You may or may not be right about the market having week fundamentals (though the ratios certainly look a lot better after this weeks adjustment), but citing a technical analysis indicator doesn’t make the case. However, Schiller PE-10 does.