It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well, I’ve got good news and bad news for everyone. The good news is winter ends in three short weeks. The bad news is that I’ve got some personal business to attend to today, so this is an espresso edition of Black Coffee. I know.

Hopefully I can make it up to you with a super-sized edition next week.

Okay, off we go …

Credits and Debits

Debit: Uh oh. More than 4.5 million people who received Obamacare subsidies in 2013 and 2014 will pay an average of $530 to the IRS this year because they qualified for a smaller benefit than they thought they were entitled to.

Debit: It’s not just Obamacare enrollees who will be writing an extra check to the IRS this year; as many as six million people who refused to buy healthcare insurance in 2014 will be hit with Obamacare’s non-compliance penalty.

Debit: Actually, Obamacare advocates insist that there isn’t a penalty for non-compliance. Why? Well, because the “Affordable” Care Act calls it a “Shared Responsibility Payment,” that’s why. Heh. Okay.

Credit: You know, George Orwell was right: The great enemy of clear language is insincerity.

Credit: Then again, no matter what you call it, some people suggest that only suckers will actually pay the Obamacare fine because the numerous exemptions and the limited IRS enforcement options make the law relatively toothless.

Debit: In case you’re wondering: No, you’re not going crazy — interest rates are ridiculously low right now. In fact, they’re at their lowest point in 5000 years. I know. In other news, water is wet and the sun is really really hot.

Debit: By the way, you better get used to low rates — some people are saying they’re here to stay. Never mind that those absurd negative rates are a telltale sign of a broken monetary system in its death throes.

Credit: Despite the extremely bearish tone that near-zero interest rates would be signaling to markets in normal times, February was the Nasdaq’s best month since October 2011. Go figure.

Credit: For his part, former Assistant Treasury Secretary Paul Craig Roberts wants to know how any credible financial analyst can support “the official economic fairy tale … despite the fact that there is no economic information whatsoever that supports it.” Good question.

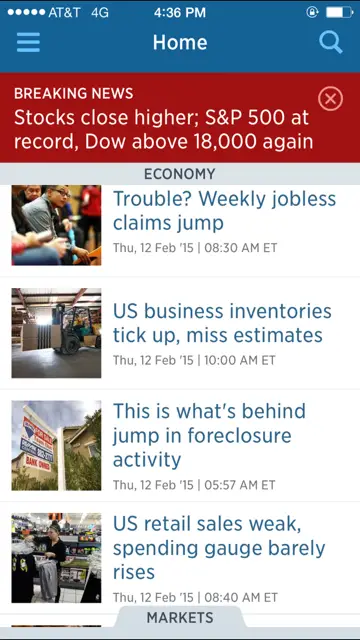

Credit: So … Just how disconnected are the markets from reality? Thad Beversdorf recently stumbled upon the answer after checking the news on his iPhone. He was so shocked at what he saw, he took this screenshot for posterity:

Credit: Welcome to Utopia, folks; obviously, it doesn’t get any better than this. Just ask Wall Street. But remember, when reality finally does reassert itself, it ain’t going to be pretty.

(The Best of) By the Numbers

According to Forbes, big families are back in style. Here are a few more facts on family size:

74,100,000 Number of children currently in US who are 17 years-old or younger.

2.06 Average number of children per woman in the United States today.

8 Average number of children per family in the 19th century.

36 Percentage of children under 18 that made up the US population in 1964 — the last year of the so-called post-WWII “baby boom.”

23 Percentage of children under 18 that make up the US population today.

$400,000 Household income threshold that has seen a significant rise in three- and four-children families.

$1,000,000 Estimated lifetime earnings lost by the typical college-educated woman after having just one child.

36 Percentage of Americans between 18 and 31 years-old who are currently living with their parents.

17 Percentage of children between 20 and 34 years-old who lived with their parents in 1980.

Sources: Forbes; USA Today; Childstats.gov; Christian Science Monitor

The Question of the Week

[poll id="50"]

Last Week’s Poll Results

How many times, on average, do you go to a movie theater?

- Rarely, if ever (63%)

- Several times per year (30%)

- Once a month (6%)

- Twice a month (1%)

- Once a week (0%)

More than 300 people responded to last week’s question. Based on the survey results, a strong majority Len Penzo dot Com readers prefer to watch movies from the comfort of their own home. Me too. The Honeybee and I will catch a flick at the theater two to three times a year — and that’s about it. All of the other movies we see are via video on demand or Netflix.

Other Useless News

Here are the top 5 articles viewed by my 6288 RSS feed and weekly email subscribers over the past 30 days (excluding Black Coffee posts):

- Dirty Harry Teaches Us a Lesson on Opportunity Cost

- 18 Things You Supposedly Should Never Pay For. Ever.

- Is It Really Worth Trying to Retire a 30-Year Home Loan in 15?

- 14 Reasons Why Treadmills Are For Suckers

- 100 Words On: Why Many “Rich” People Are Only Fooling Themselves

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

This week, BillyBob sent in a suggestion on how I could improve Len Penzo dot Com:

Would you please remove Kim Kardashian’s picture from your website? I am truly sick of looking at it.

Judging from the number of people who click on her picture, you’re in the minority, Billybob.

I’m Len Penzo and I approved this message.

Photo Credits: (coffee) brendan-; (screen shot) Thad Beversdorf

I can never answer the quizzes – doesn’t work from any computer I have.

But I have 8 siblings. Of the 9 of us, 2 have 0 children, 2 have 1 child, and 5 have 2 children.

Then again, none of us make over $400k per year for a household.

I have the same problem. Never have I been able to answer a quiz. : (

So sorry, Jeanne — and Marcia too. It all depends on the browser (and version) you are using. For example, there some versions of Internet Explorers work but others don’t. Same for the other browsers.

I’m hoping the company who distributes the voting software will fix the bug soon!

I think coming from a big family is great. If I could have afforded it, and the Honeybee wanted to, I would have had at least one or two more kids.

My mom is the youngest of 10. They’ve all passed away now except for her and one of her older brothers.