Credit card fraud is much more common than you might think. In fact, it is a multi-billion dollar industry for the criminals who choose to undertake such nefarious work. Of course, there are two big reasons why credit card fraud is so widespread: 1) it’s extremely profitable; and 2) bad credit card habits create an almost endless pool of credit card users who unwittingly aid and abet the very crooks who commit the fraud through sheer carelessness.

Credit card fraud is much more common than you might think. In fact, it is a multi-billion dollar industry for the criminals who choose to undertake such nefarious work. Of course, there are two big reasons why credit card fraud is so widespread: 1) it’s extremely profitable; and 2) bad credit card habits create an almost endless pool of credit card users who unwittingly aid and abet the very crooks who commit the fraud through sheer carelessness.

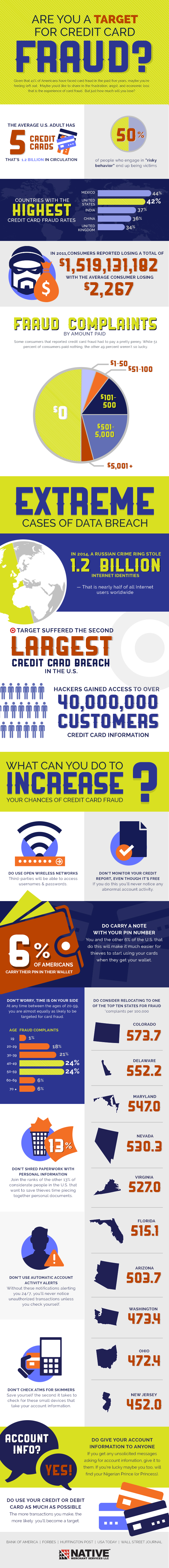

As the following infographic shows, the good news is it doesn’t take a lot of effort to minimize your risk of becoming the next victim of credit card fraud. The key is recognizing and eliminating your bad credit card habits.

Photo Credit: ionics; Infographic: NativeMerchantServices.com

Eeek! Not good! I once had my card stolen while I was traveling abroad, but, I was able to quickly notify the card company (American Express) and they cancelled the card and removed the charges from my account. Online banking makes it easier to monitor transactions and I scan every single purchase we make each month to ensure there are no illegitimate charges.

Eleven years ago, my credit card info was obtained somehow and over the course of two days, they ran up charges of around $8,500.00 I discovered it when checking my account on a whim. The card company took care of things, but I am not a trusting soul much anymore.

Every morning, I religiously check my accounts to see if there is anything fishy going on. I routinely check my credit reports as well.

Call me paranoid, but one must remain vigliant.

These are good financial habits. We froze our credit scores and have peace of mind that no one can steal our identities. If you’re not buying a house, taking out a loan or trying to get a new credit card, you’re better off with frozen credit reports. This keeps you from opening new credit cards (which you don’t need) on a whim when you’re offered a deal on the first purchase. And it give you peace of mind as miscreants can’t open new accounts in your name.

We had an unknown charge of $12 on our cc bill once. Called the bank and they confirmed it was fraudulent. They also told us that it was a common ploy; charge small amounts on thousands of cards and very few folks would bother to check on such a small amount. Our bank said fraudsters were stealing millions that way!

Wow. That is interesting, Lauren! Thank for sharing that — it looks like I really need to pay even closer attention to my credit card statements now.

I guess I will just spend less in order to use the credit card less. I guess it is a good idea all around.

I am lucky that I live in Australia. I am very careful when it comes to accessing my account. As much as possible, I do it at home and log it in the preferred website legitimately advised by my credit card provider. When it’s free, I think twice!

wow! The statistics are awfully high. we all better be extra careful especially in doing online transactions.

We had years of credit card skimmers on certain chains gas pumps. Mine was compromised once. Goofy card company calls me if I spend on EBAY but let someone steal over $1700 in 4 huge purchases in another part of the state. They bought tons of clothes, food, and booze on it.

I won’t use certain types of pump readers now.

Yep … we have to watch for those skimmers too, Bill. I know a couple of people who were victimized by them. If only these criminals would put as much effort into earning an honest living as they do trying to rip off others!

I totally agree about checking the credit card’s activity DAILY. One day I returned an item to a chain store and they credited the value to my card. The next morning my card had $13,000 in plane tickets charged to exotic places like Kuala Lumpoor and Buenos Aires. An immediate call to my Bank revealed that the charges began 20 minutes after my credit was issued. Card was cancelled with no loss to me, but then I had to wait for 2 weeks to get the new card, which was very inconvenient because I was on a trip and had expected to put everything on the card.