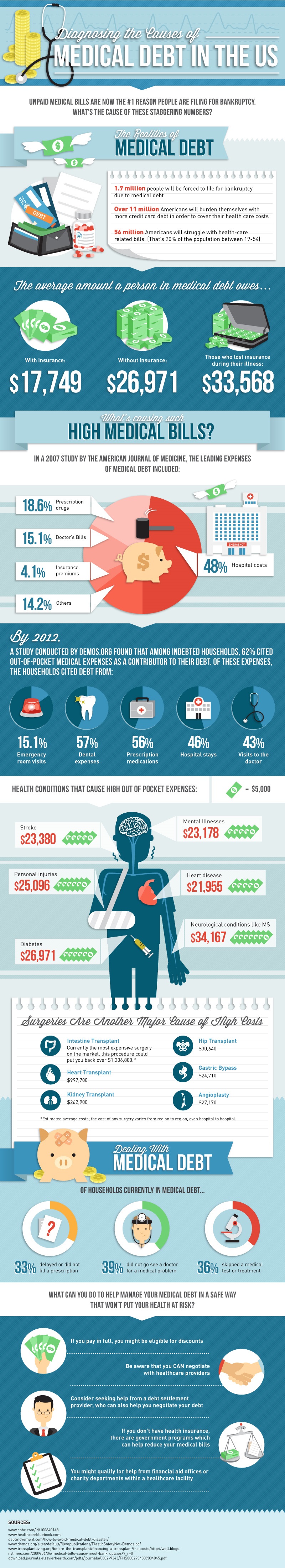

Over the last few years, medical debt has quickly become the number one reason why people file for bankruptcy in the United States. In fact, 1.7 million people will be forced to file bankruptcy because of their medical debt.

Over the last few years, medical debt has quickly become the number one reason why people file for bankruptcy in the United States. In fact, 1.7 million people will be forced to file bankruptcy because of their medical debt.

Regardless of whether you have health insurance, medical debt is a burden for many people. People who with health insurance have an average of $17,749 in outstanding medical debt and people without health insurance owe $26,971. Unfortunately, these rates only get higher; especially for those who lose their health insurance because of their chronic health conditions.

Now you’re probably wondering, why are medical bills so high? Well, there are a number of factors that contribute to the high costs of healthcare. According to the infographic below, the leading expense in medical debt is hospital costs. Prescription drugs and doctor’s bills also contribute to high medical costs.

Unfortunately, no one can predict your health nor can you completely avoid an illness or injury. The infographic below reveals a number of health conditions such as personal injuries and diabetes that contribute to high health costs. In addition, surgeries such as heart transplants and hip transplants can be very costly for patients.

While medical debt continues to increase, there are a number of ways to manage expenses. First, try paying your medical expenses in full so you can be eligible for discounts. It’s also a good idea to find out what you can negotiate with your healthcare provider and find out if you’re eligible for government assistance.

Managing medical debt is challenging, yet there are ways you can decrease costs and make payments more manageable. For more information about the realities of medical debt, check out the infographic below:

Photo Credit: Tim Green; Infographic: Ivan Serrano

Question of the Week