It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

And away we go …

Contest Time

Hey! I’m having another silver bullion giveaway! Yep. So if you’re interested, click here. The contest runs through Friday, October 24 and I’ll announce the winner in this column next week.

Credits and Debits

Credit: The stock market mixed good news with the bad this week. On the bright side, the Dow Jones Industrial Average, S&P 500, and Nasdaq all finished up at Friday’s closing bell. For the Dow, that ended a six-day losing streak.

Debit: Now for the bad news: The markets had a miserable week overall. In fact, the S&P suffered its fourth consecutive weekly decline. Believe it or not, that is its longest losing streak in three years.

Debit: It’s almost as if Wall Street took the latest Census Bureau report to heart: It says that 48 million Americans are currently living in poverty, including nearly 1 in 4 Californians. I know.

Debit: Apparently, the Dow’s run of weekly declines is beginning to raise a few eyebrows — at one point on Wednesday it was down almost 1500 points from it’s most recent peak on September 19th. The Nasdaq too; it had fallen 10.5% over the same period. Ouch.

Credit: By the way, stocks aren’t the only things falling — crude oil plunged more than 8% this week. That means gasoline prices will also continue falling. At the start of the week, the national average for a gallon of gasoline was $3.20. How low will it go?

Debit: Unfortunately, persistent oil price declines, while always great for the consumer, sometimes signal approaching trouble for financial markets. Something is definitely amiss — on Wednesday, a whiff of panic was in the air as US government bond yields experienced their biggest intraday decline in five years.

Debit: By Thursday, the stock market bulls were clearly on the run — until St. Louis Fed President James Bullard jawboned a floor under the falling market by intimating that the Fed would be restarting its quantitative easing (QE) program in the near future.

Debit: Of course, after Bullard’s remarks, for Wall Street it was on like Donkey Kong, as the Dow climbed 400 points. And so the mirage gets to live on for a little while longer.

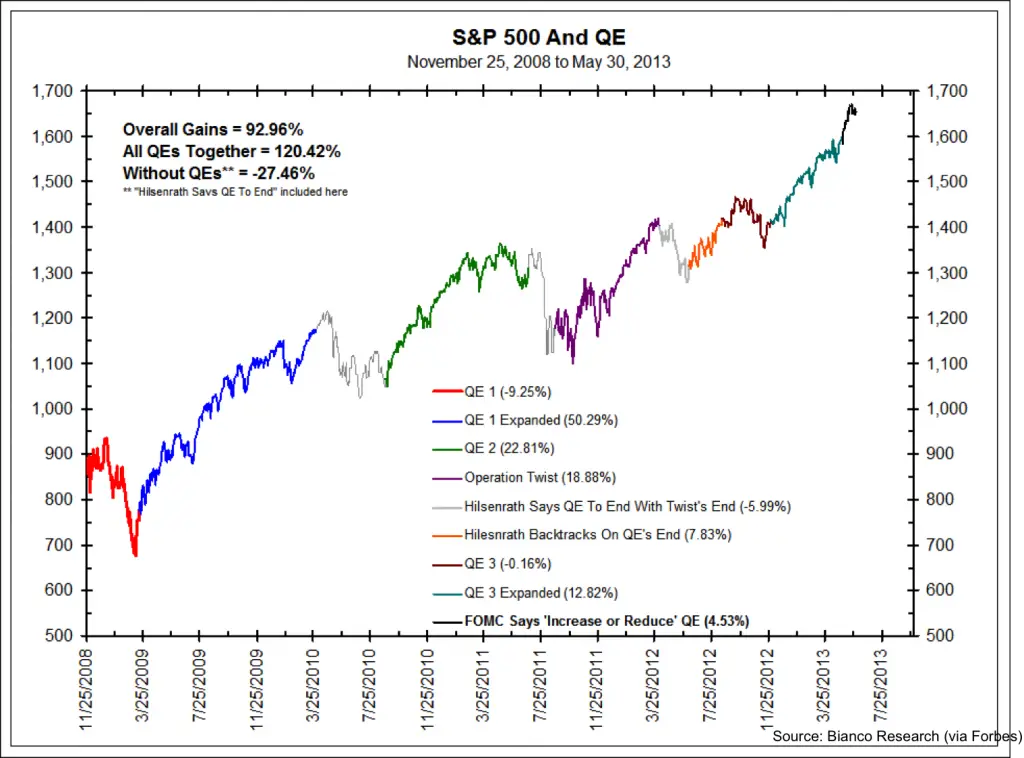

Debit: Surprised? You shouldn’t be. It’s no coincidence that the Fed’s latest round of QE is ending this month. After all, as Bianco Research points out, QE is the drug that has been responsible for juicing the markets’ performance for the past five years.

Credit: And for all of you, er, skeptics out there who keep buying the tired “recovering economy” meme, here is a graphical representation of data that suggests the market is QE-dependent and utterly incapable of standing on its own two feet anymore:

Debit: The math proves that our current debt-based monetary system is doomed — and the Fed knows it. In fact, there hasn’t been any real economic growth in years; instead, we have an illusion of growth created by Fed monetary policy.

Debit: Eventually, enough people will begin to recognize the Fed’s hocus pocus act for what is, and then all confidence will be lost — not just in the stock market, but this time in the dollar itself.

Debit: For now, though, the general population remains oblivious to the financial system sleight of hand, content with the mystical prestidigitation currently being performed by Janet Yellen and the rest of her Fed comrades.

Credit: Besides, it ain’t all bad news: USA Today is reporting that, after a long hiatus, McDonald’s will soon be reintroducing one of its most iconic sandwiches to the market. Yes, I’m talking about the McRib.

Credit: See … a little abracadabra and — presto! — the McRib is back. Just like that! No wonder consumer confidence is currently at a seven-year high. After all, a good show is always more enjoyable when there are tasty munchies on hand.

By the Numbers

Congratulations! According to the Telegraph, “If you have more than $3,650, then you are among the wealthiest half of people in the world.” Feeling rich now? More facts:

$56,000 The worldwide average net worth.

$581,000 Average net worth in Switzerland. That is the highest of any nation.

4 Rank of the United States among all nations for average net worth. ($348,000.)

35 million Number of millionaires in the world today.

$77,000 Net worth threshold to be included among the top 10% of the world’s people.

$798,000 Minimum net worth to be included among the world’s richest 1 percent.

Source: Telegraph

The Question of the Week

[poll id="30"]

Last Week’s Poll Result

Do you think college offers the best opportunity for financial success?

- It depends on the degree. (68%)

- Yes. (16%)

- No. (15%)

- I’m not sure. (1%)

Have universities finally priced themselves into irrelevancy? Possibly. More than 300 people answered this week’s survey question, and more than four out of five respondents agree, when it comes to ensuring long-term financial success — college is no longer the slam dunk it used to be. Two out of three individuals believe college only makes sense if you choose the right degree. Another 15% say going to a university is flat out not worth it.

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Manitoba (1.95 pages/visit)

2. Saskatchewan (1.78)

3. Ontario (1.72)

4. Prince Edward Island (1.71)

5. Alberta (1.69)

9. Yukon Territory (1.50)

10. Newfoundland (1.47)

11. New Brunswick (1.32)

12. Northwest Territories (1.25)

13. Nunavut (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Manitoba, eh) — or not (for the second month in a row, you hosers living on the frozen Nunavut tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter! And last, but not least…

3. Don’t forget to subscribe via email too! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

Somebody named Fairy (no, really) sent me this little note:

I can’t believe you’re not more popular because you definitely have the gift.

Really, Fairy? Tell that to the Honeybee — I’ve been trying to convince her that I’ve had “the gift” for 18 years.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Is the U$S in a bubble ?

Yes. A very very big bubble, Nicol.