The 401k — everyone has heard of it, and most of us have one, but do you realize how important your 401k actually is?

The 401k — everyone has heard of it, and most of us have one, but do you realize how important your 401k actually is?

When the government first introduced this pre-tax investment plan, it was merely meant to be an extra way to subsidize your income in retirement. There used to be a time when many people could rely on a pension from their work to help supplement their Social Security checks in retirement. Unfortunately, sometimes that just wasn’t enough. So the 401k was born.

Today, hardly any of us have a pension, and quite a few of us will most likely never receive the full benefits of social security, if any. And so the three legged stool has now become a stump, which is why it is VERY important that we now make the most of our 401k investment accounts.

Unfortunately, many individuals are not funding their investment account with as much money as they should, they are paying large fees, and their returns are bleak. They obviously need some help.

Seek Financial Advice

Like some of you, I have friends in medicine, law, and engineering who are very smart when it comes to their field of expertise — but they struggle with the concept of financial investments. Sure, they may have a 401k through their work, but they don’t really understand how much of their money is going toward fees or transaction costs, and how this is hurting them dearly in the long run. Did you know that the average investor will likely pay out over $150,000 in fees over the course of their lifetime? The truth is, people who don’t know how a 401k really operates are probably letting a lot of money slip through their fingers.

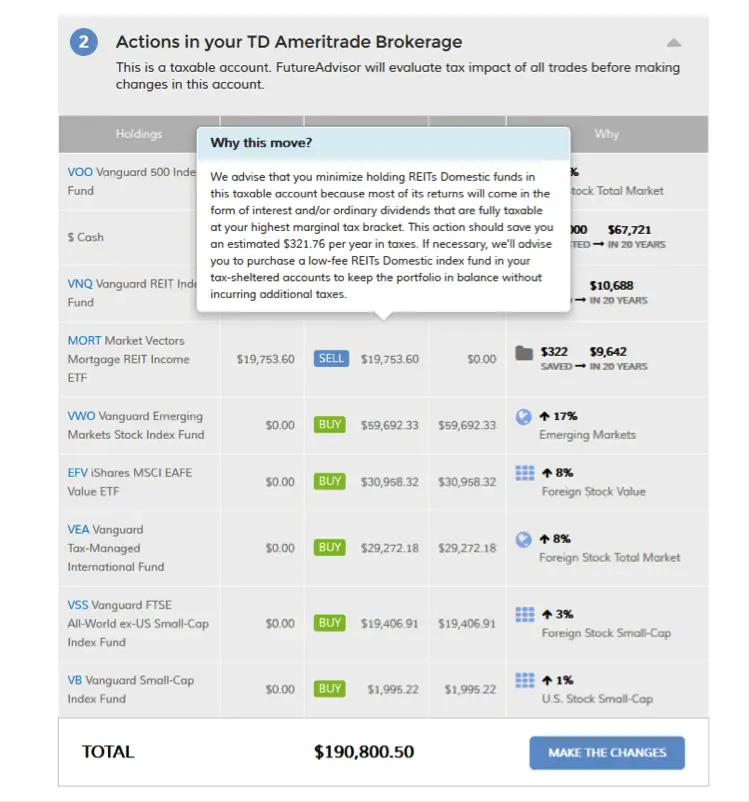

In order to get a better grasp on your 401k (and any other investment you may have), many people seek out professional financial advice from a trusted financial advisor. FutureAdvisor is just one example. They offer free financial advice online which shows you how to optimize your investment portfolio. The advice and recommendation is free, and you can also hire them to do everything for you for just one-half a percent (0.5%). That’s pretty competitive compared to the rates I’ve seen other financial advisors charge.

When it comes to advice, transparency is extremely important — I like that FutureAdvisor’s recommendations are always backed up with detailed, easy-to-understand information. Here’s a screenshot of their breakdown — it showed me exactly what trades to make and why:

Happy investing!

Photo Credit: o5com

another resource is the forum and wiki at http://www.bogleheads.org, if you are unsure about loading all of your financial accounts and passwords into a website, and willing to put in a little of your own time in learning and reading.

I actually quit my job then went back after a year. People always ask me why I left. I don’t bother telling them I left so I could cash out my 401K.

Thanks for the clarification.

Talked to the financial expert about getting out of my 401k and buying gold and silver. She said the economy is on the mend and if something were to happen that the stock market will always rebound like it has since 2008. Is this good information or a bunch of baloney, I feel baloney myself?

Also talked with a gentleman the other day who recommended contributing to a shareowner program, think it might also be called preferred stock. He said you will make much more over time then hoping your 401k is safe. He also said that during a stock market crash my money wouldnt be touched. Do you have any suggestions about this?

Thank you for your time.