Financial security is becoming the top priority for people around the globe. Gone are the days when having wealthy parents guaranteed a financially-secure life for their kids.

Financial security is becoming the top priority for people around the globe. Gone are the days when having wealthy parents guaranteed a financially-secure life for their kids.

Today, almost everyone has to work hard to ensure their financial security — and the best way to do this is by setting financial goals early on. Ideally, these goals should be a mixture of some short term and some long term goals. Here are several to consider:

Minimize Your Debt

Your most important objective should focus on eliminating any loans you might have. If you do need a loan, try to minimize the amount you borrow. And always avoid credit card debt!

Eliminate Your Credit Cards

Eliminate your dependence on credit cards. If you make it your habit to spend only what you have in your bank account, you will always be debt free. Those who are highly-dependent on credit cards, make themselves financially vulnerable to job loss and other unforeseen losses of income.

Save Every Month

Warren Buffet says that you should spend what you have after saving and not the other way around. Make a commitment to save a fixed amount every month and don’t touch it unless it’s a dire emergency. Choose a realistic saving amount so that your daily needs are not affected.

Diversify Your Investments

It’s never a good idea to carry all of your eggs in one basket. Diversify. Make small investments in different companies to maximize your returns. The easiest money to invest is the cash you get as bonus or as an unexpected inheritance. Unfortunately, people usually waste these financial windfalls by buying things they do not really need. The downside to that, as Warren Buffet reminds us, is that those who continually buy things they don’t need, eventually have to sell things they do need.

Build a Nest Egg

Set up a good retirement fund that will cover you when you want to retire. This is especially important because the economy is more unpredictable today than ever before. Just be sure to avoid making the mistake of trying to invest your retirement fund in risky endeavors with the hope of making a quick buck.

Carefully Consider the Need for a Mortgage

Home ownership and mortgages seem to have fallen out of favor with more and more people. Before buying a house for your family, take time to consider the implications. Sometimes renting is the better alternative. If you do decide to buy, try to minimize the size of your mortgage. You may be able to do this by tapping successful investments. Also be sure to consult with contractor financials for getting a secure mortgage.

These days, a secure financial future cannot be guaranteed because the financial and economic system have become too unpredictable. Today, more than ever, even millionaires who fail to properly manage their finances can end up destitute.

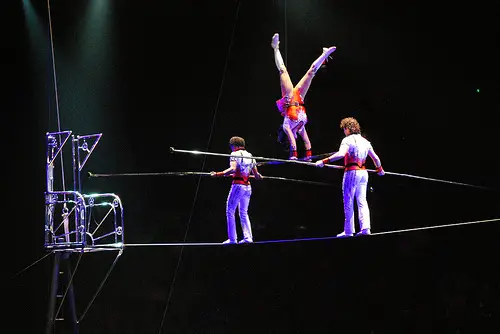

Photo Credit:wolfsavard

Question of the Week