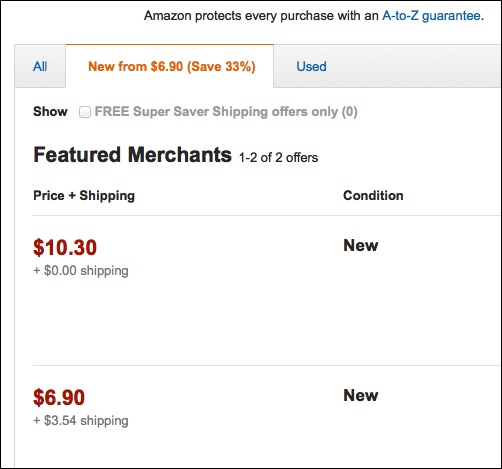

Last night I was doing a little shopping on Amazon and I came across an item that was being offered for sale by two different vendors. Here was the price summary that appeared on my screen:

So, which item is the better bargain?

On first glance, you might think the first item listed would result in a higher bill at the checkout stand. And why not? It’s $10.30 price tag is a full $3.40 more than its lone competitor selling for the seemingly bargain price of $6.90.

However, upon closer inspection, and all things being equal, the second item is actually 14 cents more expensive after including the shipping charges.

But Wait … Actually, It’s Not Quite That Simple

In case your wondering, the first item is cheaper regardless of whether or not taxes come in to play. Kinda sorta.

Let me explain:

Five states have no sales tax: Alaska, Delaware, Montana, New Hampshire and Oregon. And although that means 45 states do have one, currently, most items sold by Amazon or its subsidiaries are subject to sales tax only if they are shipped to one of the following states:

- Arizona

- California

- Kansas

- Kentucky

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Texas

- Washington

Most states include shipping charges as part of the sales tax.

Most … but not all.

If Amazon should ever expand their list to include Idaho, Iowa, Massachusetts, Oklahoma, Utah, and Wyoming — states that, according to Quicken, don’t require sales tax on shipping fees — then the calculus changes.

For items shipped to those six states, the second item in my example would be the better buy because the resulting sales tax would be significantly lower.

Got all that?

Good, because I don’t think I could muster the fortitude to try explaining it again.

Just seeing the picture, I can tell easily which has the cheaper price. It’s simple addition but you explained everything really well. Great post and yeah, I’m smarter than a 5th grader. 🙂

You forgot to factor in the potential income tax deductibility of sales tax. 🙂

Oy vey. You’re right, Kurt.

I’ll leave that one as an exercise for the student. 🙂

And to make it even more complex. In our state of Pennsylvania, necessary food and clothing are nontaxable while “extra” items are. (Bread is not and cars are.) While New York taxes everything. This gets interesting with large ticket items that can be purchased in PA and transferred for pickup to another store branch.

“Interesting” is not what I’d call it, Olivia!

My head hurts! lol 🙂

Please repeat that, or better yet, can I mail you my Amazon searches so you can figure out the best buy for my next Amazon purchase?

Send ’em to Olivia, Barb. She seems to know this stuff better than I do!

I seem to be pretty smart; got it in one :).

Once I bought a high-pressure sprayer to clean the deck. It was advertised for $19.95. With shipping and handling the total price was a little more than $35. I returned it. They refunded the total $35. I bought a comparable piece from home depot for less than $8.