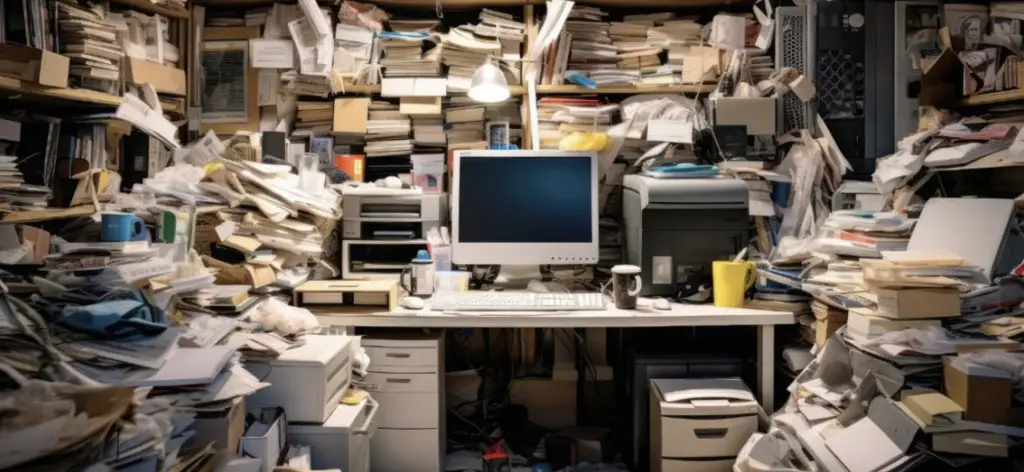

Please accept my apologies. The page you’re after must have gotten misplaced somewhere in my office. Then again, it may also be hiding on my homepage, which is much much neater than my workspace. I promise!

The offbeat personal finance blog for responsible people.