It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

And away we go …

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

— Ernest Hemingway

“The hours of folly are measured by the clock; but of wisdom, no clock can measure.”

— William Blake

Credits and Debits

Debit: As I mentioned last week, hyperinflation in the People’s Socialist Paradise of Venezuela has run its course. The currency there is now so worthless that last week a journalist spent four hours in line, at four different banks, to accumulate 10,000 bolivars — the equivalent US dollar purchasing power of six cents. This is what happens when currency dies, folks.

Debit: One side effect of any hyperinflating currency is inflating stock prices. In fact, Venezuela’s Caracas stock exchange index “soared” 3900% in 2017, far outperforming all of its South American counterparts. And although 2018 is only a month old, the Caracas index is leading the field again. The trouble is, the bolivar’s staggering losses dwarf the gains of Venezuelan stocks, resulting in a net loss of purchasing power.

Credit: Speaking of soaring stock prices, on Wednesday former Fed Chair Alan Greenspan gave a stark warning about America’s exuberant markets: “We have a stock market bubble and a bond market bubble. And, at the end of the day, the bond bubble will be the big issue.” Alan! Shush! You’re going to wake up an unwitting public. On second thought … no, you won’t.

Debit: On third thought … maybe he did. The Dow fell 666 points on Friday — on a nominal basis, that was its biggest one-day dive since December 2008. Friday’s close also led to the Dow’s worst week in more than two years.

Debit: Greenspan’s warning — and Friday’s market plunge — certainly isn’t stopping Illinois’ lawmakers who, according to Bloomberg, are so desperate to shore up the state’s massively underfunded retirement system, that “they’re willing to entertain an eye-popping wager: Borrowing $107 billion and letting it ride in the financial markets.” I’m sure that will end well.

Credit: Yes, the Illinois’ pols are a foolhardy lot — but, as Peter Schiff observes, “The impending economic collapse is hidden from most people; they only see a rising stock market, not the negative underlying factors that will cause the whole system to crash.” The exception are the smug “even a broken clock is right twice a day” crowd — they see the underlying factors, but refuse to acknowledge them.

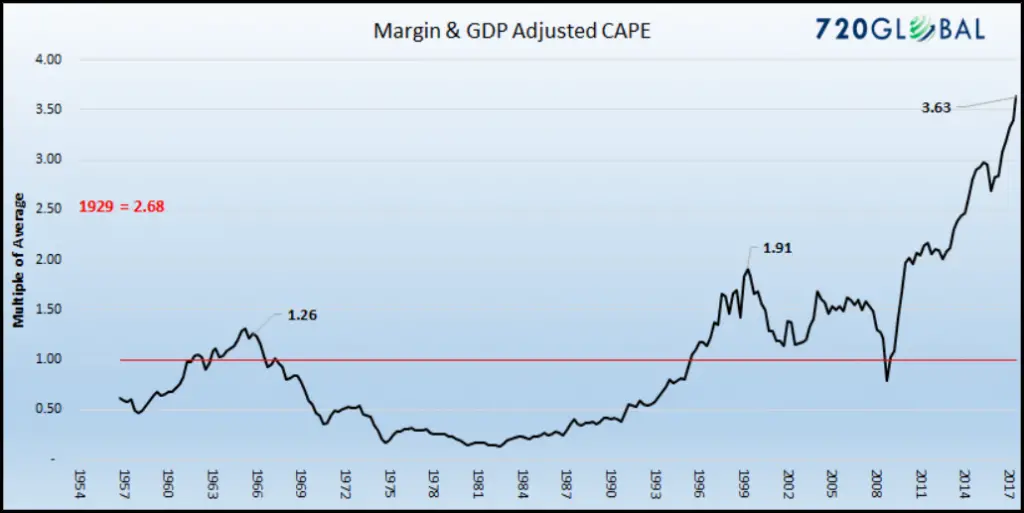

Credit: Indeed, the current US stock market valuations clearly defy any comparisons to the past. According to Michael Lebowitz, “At over 350% above the mean, stock investors are currently paying significantly more for a unit of economic growth than at any time in the last 70 years.” See for yourself:

Credit: To put that in perspective, Lebowitz notes, “The simple fact is that investors are paying over three times the average, and almost twice as much as the prior peak, for a dollar of economic growth. Furthermore, it is happening late in the economic cycle, (when) the outlook for growth, even if one is optimistic, is well below that required to justify such a level.” I know. Yet more blasphemy for the market bulls.

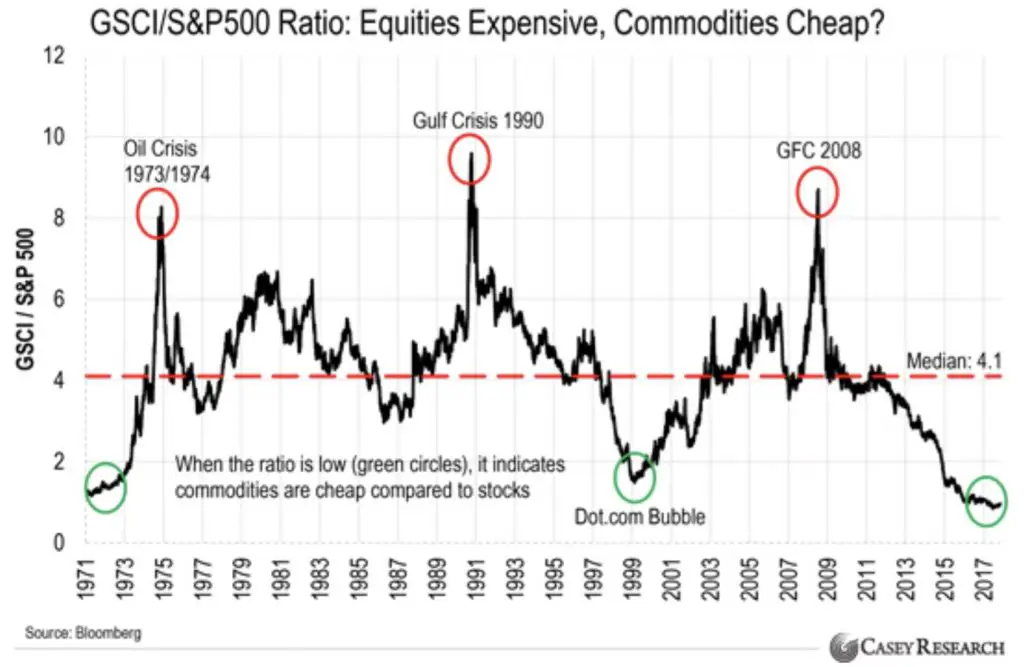

Credit: More heresy: Look at the following chart of the GS commodity index versus the S&P since 1971; the ratio is at an all-time low. According to Egor Von Greyerz, “This cycle is now turning and the ratio is likely to go well above the 1990 high; that’s a 10-fold increase from here.” We’ll see. Then again, I’m sure this time is different. I know because the bulls keep telling me so.

Debit: Of course, it’s no coincidence that commodity prices are starting to climb again at the same time that the US dollar is off to its worst start since 1987 — a year which started out exactly like this year, with a booming stock market and everybody enjoying the party. Of course, we all know what happened later that year — Black Monday.

Debit: Ironically, we have an extremely weak dollar despite the Fed’s campaign to raise interest rates. As Bill Holter notes, “That ‘should not’ happen.” No, it shouldn’t. According to Holter, the only other time a similar scenario occurred was way back in … wait for it … 1987, when rates climbed from 7% to 10% in nine months at the same time the dollar fell sharply. Yeah, yeah … Correlation. Causation. No relation. I get it.

Debit: In the eyes of tin foil hatters — including yours truly — commodity inflation, rising interest rates, and the falling dollar are all clear signs that even higher inflation and, ultimately, hyperinflation are coming this way. The million dollar question is: when? I wish I knew, but I don’t. If it’s a “bolt from the blue” — as I suspect it will be — there’ll be little time to react. In that case, a broken clock is better than no clock at all.

By the Numbers

Here’s a closer look at some factoids and tidbits about this year’s Super Bowl in Minneapolis between the Philadelphia Eagles and the Evil Empire:

2 Times Minneapolis has hosted a Super Bowl. (The Washington Redskins defeated the Buffalo Bills, 37-24, in 1992.)

6 Times the Super Bowl has been held in a cold-weather city.

41,000 Hotel rooms booked in the Twin Cities metro area during Super Bowl weekend.

$4945 The average cost of a ticket to the past five Super Bowls.

$5700 Average ticket price for this year’s Super Bowl on the secondary market.

$5,000,000 Average cost of a 30-second ad during the Super Bowl; that’s up 87% since 2008.

1,350,000,000 Chicken wings that will be eaten during the Super Bowl.

14,500 Tons of chips eaten during the big game.

8,000,000 Pounds of guacamole expected to be consumed on Sunday.

10,000,000 Pounds of ribs that will be eaten.

Source: Journal Sentinel

Insider Notes: My 2017 State of the Household Report

I’ve said it before and I’ll say it again: When it comes to money management, one of the most important pieces of information anyone can have is a detailed summary of where your household income was spent during the previous year. For the past 20 years, I’ve been diligently using an Excel spreadsheet to track almost every facet of my household expenses — and that discipline has provided me with extraordinary insight into my short- and long-term household spending patterns …insight that reveals priceless spending and saving information that allows me to optimize my personal finances.

Hopefully, this summary of my household expenses and net worth assessment for 2017 will inspire you to track your expenses with the same rigor — so let’s get started!

Unless you need to liquidate all your assets, net worth is a relatively unimportant metric when it comes to personal finances — so I only check my net worth once per year. However, by looking at the annual percentage change it is a good indicator of whether or not your personal finances are improving — or possibly taking a turn for the worse.

Hey! You need to be an Insider to view the rest of this article! To join, please click “Insider Membership” at the top of my blog page.

Last Week’s Poll Results

What’s the smallest coin you’d ever consider picking up off the street?

- Penny(39%)

- Nickel (21%)

- Quarter (20%)

- Dime (10%)

- None (7%)

- Half-dollar (2%)

- Dollar (1%)

More than 1500 Len Penzo dot Com readers responded to last week’s question and it turns out that 2 in 5 say they wouldn’t bend over to pick up a coin smaller than a dime. Even more telling, 7% of those who responded say they wouldn’t bother to pick up any coin — no matter how big it was. Folks … That is an excellent — if not extremely sad — illustration of just how much value the “Almighty Dollar” has lost over the years.

The Question of the Week

[poll id="200"]

Other Useless News

Programming note: Unlike most blogs, I’m always open for the weekend here at Len Penzo dot Com. There’s a fresh new article waiting for you every Saturday afternoon. At least there should be. If not, somebody call 9-1-1.

Hey! If you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Don’t forget to subscribe via email too! Thank you.

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider!

Letters, I Get Letters

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Here’s an odd message I received in my inbox this week from Joriss:

“Your blog is a total squander of time!”

Are you a professional fortune cookie writer, Joriss?

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Yuck it up future welfare recipients !!!

Beware of profits making a prophet, Mik!

This was the best January for stocks since 1987 too. So there’s another similarity. Maybe another Black Monday **is** right around the corner. Friday’s big drop makes me think the markets have finally exausted themselves.

I don’t think a Black Monday is even possible today with the circuit breaker rules. That day saw the Dow lose more than 22% of its value in a single day. I think the max single-day loss is now 10% … or something like that.

Imagine a scenario where the market falls like a flash crash on steroids and investors are trapped. We’ve been told that can’t happen because circuit breakers are in place to arrest panic style moves, but if trading is halted, and the market simply does not reopen for days (or weeks or even months) then suddenly it’s a new game.

Interestingly, at the beginning of the week, my husband and I had many discussions about the merits of selling some of our bond and/or bond funds. Many were trading at a premium so it seemed prudent to sell, reap the profit and purchase something else, perhaps even other bonds trading at a discount. Didn’t move fast enough and yesterday we lost $28K (on paper) over the entire portfolio. I think the irrational exuberance will return and then we will move more quickly to sell. Bonds have served us well over the last decade or more s but we do think it is time to get out of some or all. Question is, what to invest the proceeds in that comes even close to some of those high coupon bonds

UST 10 yr note yield hit a 4-yr high yesterday which is what caused stock mkt sell off. UST yield peaks come before recessions and/or bear markets. The last UST 10Y yield peak was in 2007, prior to that mid 2000, etc. etc.

Indy is right, Kathy. The bond market (the “smart money”) looks like it officially rolled over last September. If so, stocks may finally be getting the memo.

For me, the juicier question is: When the stock market bull is officially dead, will the bond market return as a safe-haven, or will bond prices continue falling too? If it’s the latter scenario, then look out!

“In the eyes of tin foil hatters including yours truly…” – Len

I know the feeling Len.

But we’re in for worse yet – the resentment and envy we will “enjoy” when the “wise ones” see us prosper while they suffer “victimhood”.

RD,

By living a fairly self sustaining lifestyle, I don’t hope to prosper….merely not to suffer as much what the general population will in the severe economic chaos I think is coming.

But you’re right….even that I think will generate resentment.

Thanks, Andy. “Prosper” was the wrong word.

At a minimum, we’ll be able to get our broken clocks fixed, Dave!

“Heres a closer look at some factoids and tidbits about this years Super Bowl in Minneapolis between the Philadelphia Eagles and the Evil Empire:”

I guess you’re not a Patriots fan.

Only on the days that they lose, Shaun.

I agree. You are a card carrying member of the tin foil hat club. But it is hard to argue with your POV on a lot of things which is why I keep coming back every week.

I have no problem with those who disagree with me, Jason. We’d all be in a much better situation today if people were willing to read and listen to others with opposing viewpoints. Healthy debate is important; those who insist on stifling it — for whatever reason — do so because they can’t defend their position.

How is it that Greenspan can see not one, but TWO bubbles NOW, but he was UNABLE to correctly identify ANY of the asset bubbles he was inflating back when he was the Fed King?

Sir Alan speaks with forked tongue.

He wrote in favor of a gold standard prior to his reign as FED chairman, then spent his time in office helping to suppress the price of gold..so I don’t waste time listening to anything he says.

Andy and Oscar: You both make good points. No doubt Greenspan sold old when he took the role of the Fed chair. It’s very disappointing.

He completely compromised his values and principles which indicates a tremendous lack of character on his part. I’m sure Ayn Rand, who used to be his mentor, has rolled over in her grave more than a few times since then.

“To achieve, you need thought. You have to know what you are doing and that’s real power.” – Ayn Rand

That’s been true in my experience. Think a project all the way through, before you start. See the “mistakes” in your mind’s eye before they happen and then power your way through to the realization of your corrected enterprise.