It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Okay, away we go …

“Price is what you pay. Value is what you get.”

— Warren Buffett

“Don’t be seduced into thinking that that which does not make a profit is without value.”

— Arthur Miller

Credits and Debits

Credit: I see filings for unemployment benefits plunged last week to the lowest level since 1973. Yes, that 1973. You can thank all of the returning employees who were previously unable to work due to the recent hurricanes.

Debit: Meanwhile, this past week marked the 30th anniversary of Black Monday. On that fateful day, the Dow lost 22.6% of its value. A similar plunge today would see the Dow fall more than 5200 points by the closing bell. The good news is there are now circuit breakers in place to slow the rate of descent. The bad news is, those circuit breakers only halt trading for 15 minute periods — so a similar crash is still possible.

Credit: For those of you keeping score at home, bitcoin hit $6000 on Friday. It has since pulled back a bit — but by the end of the day it was still trading near $5950. As recently as January 12th, the cryptocurrency was selling for “just” $802.

Credit: Bitcoins are basically nothing but a series of ethereal ones and zeros stored on magnetic hard drives — unlike precious metals, which are tangible items that you can actually hold and measure by weight. That’s why gold and silver were important in Puerto Rico after Hurricane Maria wiped out the island’s electrical grid, and bitcoin was not. Let that be a lesson for you on the difference between price and value.

Debit: Despite what happened in Puerto Rico after the hurricane, a single bitcoin is still four times more expensive than a troy ounce of gold, and nearly 350 times more than a silver American Eagle or Canadian Maple Leaf. The bottom line is this: Speculators are more concerned with price, while investors and those worried about counterparty risk are more concerned with value. Which one are you?

Debit: Just remember, if you own precious metals, make sure they’re in your possession. And whatever you do, for God’s sake, don’t store it in a bank! This week, asset manager Egon Von Greyerz reported that at least two of his clients in Switzerland are being refused access to gold they put in Swiss banks for “safe keeping.” Strange. Say, you don’t think those shady banks took their clients’ gold and … Nahhh.

Debit: On a somewhat related note, the US has been living above its means for the past 50 years. Not only has America run a real budget deficit every year since 1961, but also a trade deficit every year since 1975.

Debit: Of course, those deficits eventually caused Richard Nixon to break the dollar’s anchor to gold in 1971. That, in turn, forced the creation of the petrodollar to prevent runaway inflation in the US. Unfortunately, when the petrodollar system finally dies, Americans’ artificially-juiced standard of living will fall sharply. At least temporarily, until the US begins making things at home that it imports today.

Debit: It’s also no coincidence that the rise of financialization followed the dollar’s decoupling from gold in 1971. However, Charles Hugh Smith says financialization is like flying into a box canyon because, “Once you start down the path of phantom wealth created by debt and leverage, there’s no turning back.” Yep. Our debt-based currency lent out at compound interest is that rock wall — and it’s coming up fast.

Debit: Speaking of box canyons and rock walls, Illinois is past the point of no return; the state can no longer raise enough taxes or cut spending to reduce its annual bond costs and retiree benefits to a sustainable level. In other words: it’s essentially bankrupt. “Not because of too much bonded debt,” analyst Carl Dincesen notes, “But rather the government promising retirement benefits that aren’t affordable.” Ya think?

Credit: And finally … Bernie Sanders continues to push his socialist agenda to anyone gullible enough to believe it. This week, he explained how things will work when he’s in charge: “You’re going to be paying more in taxes; everybody will pay more. But you’re gonna get free health care, and maybe you’re gonna get free child care, and maybe your kids are gonna be able to go to college tuition-free.” Really, Bernie? Free?

By the Numbers

After three hurricanes, California’s wildfires and other less-publicized natural disasters, 2017 is shaping up to be one of the worst years ever for costly natural disasters:

15 The number of natural disasters this year that have racked up at least $1 billion in damages.

2011 The year that suffered the most natural disasters with $1 billion or more in damages. (16)

$33,000,000,000 The average annual cost of big disasters.

$6,000,000,000 The high-end estimated cost of this year’s California wildfires.

$222,000,000,000 The estimated combined damages caused by 2017 Hurricanes Harvey, Irma and Maria.

$51,000,000,000 Amount Congress has appropriated to-date towards 2017 disaster relief.

Source: The Hill

The Question of the Week

[poll id="185"]

Last Week’s Poll Result

How much is your monthly rent or mortgage payment (excluding taxes and insurance)?

- Less than $500 (39%)

- $1001 to $2000 (27%)

- $500 to $1000 (24%)

- More than $2000 (10%)

More than 1200 people answered this week’s survey question and almost 2 in 5 are fortunate enough to be spending less than $500 per month on their rent or mortgage payment. At the other end of the spectrum, 37% allocate more than $1000 for their monthly shelter expense. For what it’s worth, the conventional wisdom is that you spend no more than one-third of your monthly income on housing.

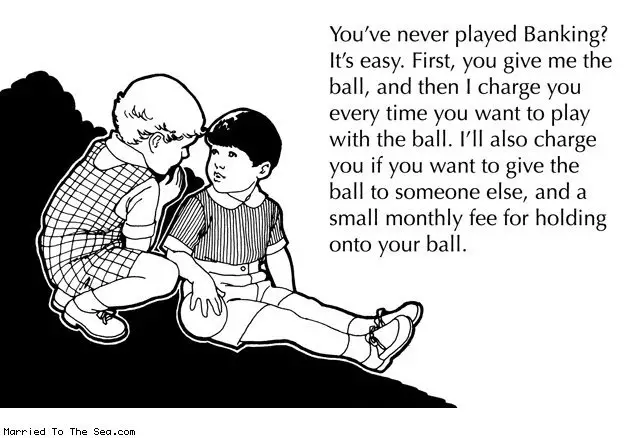

Useless News: The Banking Game

Other Useless News

Here are the top — and bottom — five Canadian provinces and territories in terms of the average number of pages viewed per visit here at Len Penzo dot Com over the past 30 days:

1. Manitoba (2.13 pages/visit)

2. Alberta (1.78)

3. New Brunswick (1.76)

4. Quebec (1.45)

5. Newfoundland and Labrador (1.41)

9. Nova Scotia (1.37)

10. Yukon Territory (1.33)

11. British Columbia (1.30)

12. Nunavut (1.25)

13. Northwest Territories (1.00)

Whether you happen to enjoy what you’re reading (like those crazy canucks in Manitoba, eh) — or not (ahem, you hosers living on the frozen Northwest Territories tundra) — please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

After reading my article explaining why Boardwalk is not the most valuable property in Monopoly, Rick asked this question:

Have you ever played Monopoly where a fight at the end hasn’t happened?

Wait … you mean Monopoly actually has an end?

I’m Len Penzo and I approved this message.

Photo Credit: (coffee) brendan-c

Len, I think Monopoly is REALLY boring. Once all the properties are bought up, it gets monotonous.

Thanks for another great addition of Black Coffee!

Sara

Once somebody acquires a couple of key property groupings, then the game is all but over and from that point on it simply becomes a game of attrition. Everybody can usually see it, which makes playing out the string a formality, which isn’t a lot of fun for the losers.

According to Aristotle, money has four characteristics:

1. Durable- the medium of exchange must not weather, fall apart, or become unusable. It must be able to stand the test of time.

2, Portable- relative to its size, it must be easily moveable and hold a large amount of universal value relative to its size.

3. Divisible- should be relatively easy to separate and put back together without ruining its basic characteristics.

4. Intrinsically Valuable- should be valuable in of itself, and its value should be totally independent of any other object. Essentially, the item must be rare.

Not sure bitcoin meets all of these.

Aristotle seems to have left off the most important characteristic: it has to be a proven long term STORE OF VALUE!

I do agree bitcoin is less than durable (requires electricity), and it is not intrinsically valuable; if the fiat currency goes belly up, then how is it valued?

Len,

I think the reason everyone is gravitating toward Bitcoin is because its not manipulated like the precious metals markets. Some analyst suggest that the bankers created Bitcoin in order to start the transfer to a cashless society, it certainly sounds like something these evil people would do. Its really hard to tell how long the Dollar system will last, with the average American sheep so dumbed down it could be another decade. I dont think it will be the average American sheep waking up, but the new Petro Yuan that will do the Dollar in. It also looks as if the Yuan and Ruble might be joining together, the Russians just signed some arms deal with the Saudis and if I remember correctly that was one of the stipulations we had with the Saudis when the Petro Dollar wats born.

All in All it does get old seeing gold and silver manipulation year after year, I understand why so many are giving up, but Im very hard headed. LOL

Jared

Those who are “giving up” on precious metals bought them for the wrong reasons, Jared. They may not want to admit it, but they were merely speculators/investors — not people looking to insure their wealth.

What if I don’t want or have a need for “free” child care? Or “free” tuition? Or “free” healthcare (this applies to the young and healthy, where the odds of a catastrophic illness are slim)? The answer is I’m still going to have to pay for all that “free” stuff whether I use it or not. Besides redistributing wealth, socialism limits freedom of choice and imposes one size fits all government imposed solutions on everybody. No thank you.

The only thing socialism ensures is equal misery for everyone.

If the S&P falls more than 20% in a single day then trading is halted until the next day.

That’s what it says in the fine print. I can imagine a scenario where they may keep the markets closed for a week or more.

Once the dollar’s tie to gold was broken for good by Nixon, it meant that every dollar in your pocket and every dollar in your bank account, plus your home and every other asset, including the blood, sweat & tears spent on the job, all belong to the government and their crony bankers. What’s sad is most people have no idea. They think constantly higher prices is as natural as the sun rising in the east and setting in the west.

That inflation is a hidden tax on all of us. The mainstream media, central bankers, and the government have successfully indoctrinated most people to fear deflation and believe that “a little” inflation is good. I blame our education system for this.

The fact of the matter is, people should welcome mild deflation, as it increases our purchasing power — even in the absence of a pay raise. On the other hand, even 2% annual inflation, which the Fed is openly clamoring for, halves the dollar’s purchasing power in roughly 34 years.

Richard Russell said never buy gold or silver to make a profit. Its for insurance and maintaining purchasing power.

Richard Russell was one of the great ones. RIP.

What good are banks for anymore? You get zero interest on your savings. Small business loans are almost impossible to get these days. And if that isn’t enough, they’re risky as hell.

Here’s another one: They will happily accept very large deposits from you, but if you want to withdraw more than a few thousand bucks in a single day, then they get grumpy — and often ask you to come back a day of three later.

If that doesn’t tell you what a sham the entire banking industry is, then I don’t know what else to say.

Hmmmm….let me think about it

Bitcoin: A totally made up electronic currency that could disappear in a computer crash, or hack, or by govt decree, not understood nor accepted by most, and facing the competition of an unlimited number of competing made up electronic currencies. Seems there is a electronic record of every transaction from creation thru spending to current location.

Gold/silver: While currently not in great favor in this country (although I have paid for dental work, kitchen counter tops, etc with gold), you can hold it in your hand (or hole in the ground), knowing where it actually is at night. Has a history of thousands of years as MONEY, and IS widely accepted in many places in the world. Totally private in use and possession unless you choose different.

I think that is an excellent summary, Andy. Well done, sir.

A comment on housing cost survey — i marked “under $500” but my house is paid for and you had no answer available for that :). Wondering how many others were in the same situation….

I do not know how many of those who said “Under $500” had a paid off mortgage. Since you are the fourth person who has asked about that in the past week or so, I’ll make sure the next question of the week will be about paid off mortgages .