Grandfather knew when he retired nearly fifty years ago what it would be like.

He thinks the reason that he knew was because there were things he wanted to do that he had to forgo when he was hired out to “the other man” and would now have free time of his own to do. The idea that happily-retired folks don’t do anything brings a smile; we just work in a different direction, for ourselves.

Now, every day is like the weekend was when we were employed.

In these rapidly changing economic times, Grandfather says he thinks folks of all ages should prepare themselves for post-employment life, psychologically as well as financially.

In your free time, do things you really want to do. You will get even better at them and enjoy them more when your time is your own.

***

About the Author: RD Blakeslee is an octogenarian from West Virginia who built his net worth by only investing in that which can be enjoyed during acquisition and throughout life, as opposed to papers in a drawer, like stocks and bonds. You can read more about him here.

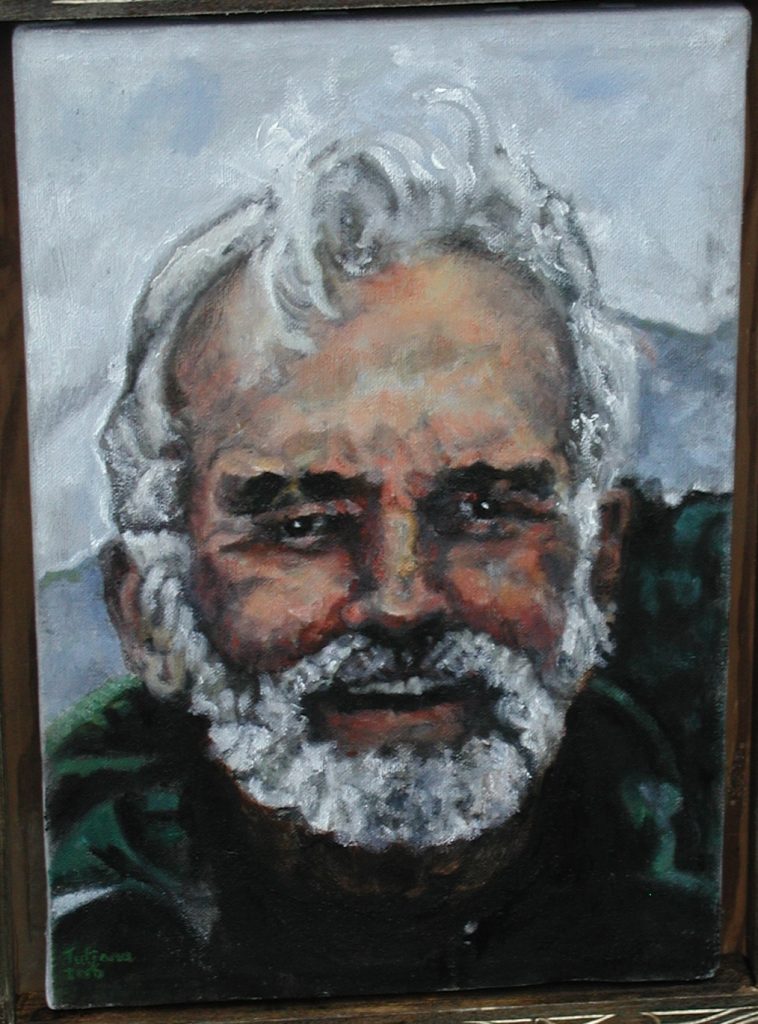

Photos: Courtesy of the Blakeslee Family

We are working on minimalist lifestyle. Living with less will allow us more time to enjoy our free time. I always said I would never retire I would just stop working for someone else.

There you go!

Perfect, and you will find you won’t need to live a minimalist lifestyle forever.

Good advice. I’ve heard that one of the biggest reason people go back to work after retiring is boredom. I would think you’ve got to have a lot of honey-do’s and hobbies to avoid being retired for almost 50 years. Congrats!

thanks, salamander.

It’s been a bit more than honey-dos and hobbies though, e.g:

https://lenpenzo.com/blog/id46608-grandfather-says-grandfathers-house-and-custom-built-stairs.html

https://lenpenzo.com/blog/id46365-grandfather-says-working-with-stone.html

https://lenpenzo.com/blog/id46644-grandfather-says-a-lesson-on-real-estate-development.html

https://lenpenzo.com/blog/id46762-grandfather-says-hes-a-cowman-he-hasnt-been-a-boy-in-years.html

“In your free time, do things you really want to do. You will get even better at them and enjoy them more when your time is your own.”

Yes! And who knows … you may even be able to turn it into a side hustle that earns a little extra spending cash!

Right on!

My cattle herd earned a little and the studio for my wife (details in the URLs cited above) earned her some. These enterprises also “circulated” us widely our community.

… but the “biggie, so to speak, came when we sold the timber which had been quietly growing for years while we enjoyed the land.

https://lenpenzo.com/blog/id22017-how-i-live-on-less-than-40000-annually-ralph-from-west-virginia.html

Is there any chance you can harvest the timber again in a few years for another round of extra cash?

It would be possible, Len, but we probably won’t do it.

Timber grows exponentially more valuable year after year (up to a point) as its girth increases and us old folks don’t need any more money. The kids will inherit the windfall (Chainsaw fall, actually).

I tell them that I was lucky to have lived and prospered during the height of our culture (IMO); the third quarter of the twentieth century and I am trying to transfer some of that to them, as compensation for their support of my generation (Social Security payments, etc.), because they are unlikely to benefit from their payments as I have.

I don’t believe in luck when it comes to the success or failure of my enterprise, but it surly does exist otherwise, as when one is born, of whom and where.

… all of which brings to mind the inter-generational relationship within our family a half-century ago. The children were expected to mostly make their own way financially, as they prepared for adult life.

All five got some secondary education. Four used this-or-that well worn surplus family car for commuting to school:

https://lenpenzo.com/blog/id52362-grandfather-says-a-look-back-at-the-29-cars-ive-owned-during-my-life.html

Harvard, etc,? Nope. None of us ever aspired to join the ranks of the elite or adopt their ways. We were given a social entre in Warrenton VA, years before, when we joined the old-money folks there in land conservation efforts. We declined it.

One child had a physical problem which made her spirit tender and she was transported across two mountain ranges and back every weekend, to nursing school on Roanoke, Va. She earned her RN, and I mean she earned it.

The trips back across the mountains after delivering daughter to Roanoke included stops to pick up beautiful large stones, which were used to build the stone wall, URL link to that episode is in an earlier post.