When numbers get into the billions or trillions, they start to lose context.

When numbers get into the billions or trillions, they start to lose context.

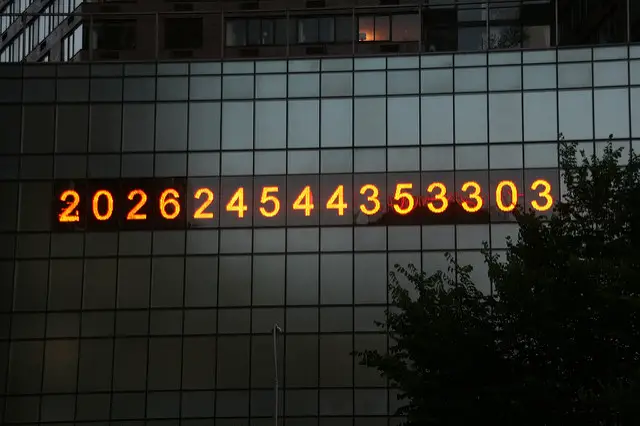

The U.S. national debt is one of those numbers. It currently sits at $19.5 trillion, which is actually such a large number that it is truly difficult for the average person to comprehend.

How big is the U.S. National Debt?

The best way to understand these large numbers is to represent them visually, by plotting the data with comparable numbers that are easier to grasp.

The following visualization plots the U.S. National Debt against everything from the assets managed by the world’s largest money managers, to the annual value of gold production. Specifically:

1. The U.S. national debt is larger than the 500 largest public companies in America. The S&P 500 is a stock market index that tracks the value of the 500 largest U.S. companies by market capitalization. It includes giant companies like Apple, Exxon Mobil, Microsoft, Alphabet, Facebook, Johnson & Johnson, and many others. In summer of 2016, the value of all of these 500 companies together added to $19.1 trillion — just short of the debt total.

2. The U.S. national debt is larger than all assets managed by the world’s top seven money managers. The world’s largest money managers — companies like Blackrock, Vanguard, or Fidelity — manage trillions of investor assets in stocks, bonds, mutual funds, ETFs, and more. However, if we take the top seven of these companies and add all of their assets under management (AUM) together, it adds up to only $18.9 trillion.

3. The U.S. national debt is 25x larger than all global oil exports in 2015. Yes, countries such as Saudi Arabia, Kuwait, and Russia make a killing off of selling their oil around the world. However, the numbers behind these exports are paltry in comparison to the debt. For example, you’d need the Saudis to donate the next 146 years of revenue from their oil exports to fully pay down the debt.

4. The U.S. national debt is 155x larger than all gold mined globally in a year. Gold has been recognized as wealth and money for a long time — but even the world’s annual production of roughly 3,000 tonnes (96 million oz) of the yellow metal barely puts a dent in the debt total. At market prices today, you’d need to somehow mine 155 years worth of gold at today’s rate to equal the debt.

5. In fact, the national debt is larger than all of the world’s physical currency, gold, silver, and bitcoin combined. That’s right, if you rounded up every single dollar, euro, yen, pound, yuan, and any other global physical currency note or coin in existence, it only amounts to a measly $5 trillion. Adding the world’s physical gold ($7.7 trillion), silver ($20 billion), and cryptocurrencies ($11 billion) on top of that, you get to a total of $12.73 trillion. That’s equal to about 65% of the U.S. national debt.

See for yourself …

* * *

Source: The Money Project — an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

Photo Credit: bronclune; Infographic: The Money Project

Very cool article. Thanks for sharing.

I agree that numbers that big become very abstract and start to lose meaning. Your examples and illustrations (not to mention the infographic) really help drive home how crazy huge that debt figure really is!

Thanks, Jay.

A very eye opening and sobering way of visualizing just how bad shape the U.S. is in. I don’t think it can ever be repaid, but is especially won’t if we continue to borrow for unnecessary spending. Of course if a candidate gets in and proposes any type of budget cuts, that person will be run out of office and accused of hating the ____________(insert your own noun).

And yet we expect families to live within their means.

Yes, most voters say they worry about the debt, but they also like their freebies. As Ben Franklin supposedly said:

“When the people find that they can vote themselves money that will herald the end of the republic.”

We passed that point many decades ago — and we are finally on the verge of reaping what we have sown.